Compare Mutual Funds

Compare up to 5 mutual funds side-by-side to make informed investment decisions.

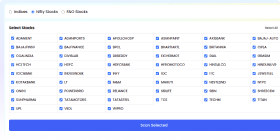

Select Funds to Compare

Add or remove up to 5 mutual funds to compare their performance and metrics.

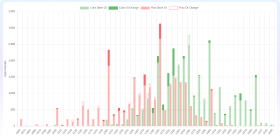

NAV History Comparison

Sector Allocation Comparison

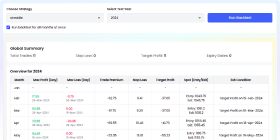

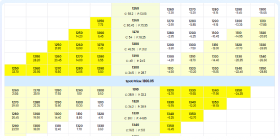

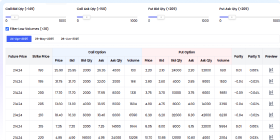

| Metric |

Kotak Nifty Midcap 150 Momentum 50 Index Fund Direct Growth

Kotak Mahindra Mutual Fund

Equity

Mid Cap

|

|||

|---|---|---|---|---|

| Fund Details | ||||

| NAV | ₹ 18.41 (21-Apr-2025) | ₹ 111.85 (21-Apr-2025) | ₹ 10.76 (21-Apr-2025) | ₹ 8.69 (21-Apr-2025) |

| Fund Size | 396.04 | 1981.66 | 57.09 | 95.85 |

| Expense Ratio (%) | 0.26 | 0.56 | 0.92 | 0.28 |

| Risk | Very High | Very High | Very High | Very High |

| Min Investment (₹) | 100 | 5000 | 5000 | 100 |

| Min SIP (₹) | 100 | 500 | 1000 | 100 |

| Exit Load | Exit load of 0.25% if redeemed within 7 days. | Exit Load for units in excess of 10% of the investment,1% will be charged for redemption within 12 months. | Exit Load for units in excess of 10% of the investment,1% will be charged for redemption within 3 months. | Nil |

| Returns | ||||

| 1Y Return (%) | 11.73 | 10.6 | N/A | N/A |

| 3Y Return (%) | 22.04 | 18.64 | N/A | N/A |

| 5Y Return (%) | N/A | 30.57 | N/A | N/A |

| Top Holdings | ||||

| Top 10 Holdings |

Max Healthcare Institute Ltd.

4.99%

BSE Ltd.

4.55%

Persistent Systems Ltd.

3.59%

Coforge Ltd.

3.28%

PB Fintech Ltd.

3.22%

Dixon Technologies (India) Ltd.

3.11%

Lupin Ltd.

3.0%

The Federal Bank Ltd.

2.89%

Indus Towers Ltd.

2.7%

SRF Ltd.

2.61%

|

PB Fintech Ltd.

3.21%

The Indian Hotels Company Ltd.

2.78%

Hitachi Energy India Ltd.

2.76%

The Phoenix Mills Ltd.

2.7%

The Federal Bank Ltd.

2.43%

Persistent Systems Ltd.

2.23%

Lupin Ltd.

2.2%

Indian Bank

2.19%

Navin Fluorine International Ltd.

2.12%

Ipca Laboratories Ltd.

2.12%

|

Hitachi Energy India Ltd.

3.85%

Fortis Healthcare Ltd.

2.52%

Bharti Hexacom Ltd.

2.47%

Glaxosmithkline Pharmaceuticals Ltd.

2.47%

Apollo Hospitals Enterprise Ltd.

2.46%

Muthoot Finance Ltd.

2.44%

Patanjali Foods Ltd.

2.43%

Vishal Mega Mart Ltd.

2.42%

Max Financial Services Ltd.

2.42%

Aditya Birla Capital Ltd.

2.42%

|

BSE Ltd.

5.75%

The Indian Hotels Company Ltd.

5.18%

Max Healthcare Institute Ltd.

5.1%

Persistent Systems Ltd.

4.92%

Coforge Ltd.

4.88%

PB Fintech Ltd.

4.46%

Lupin Ltd.

4.31%

Dixon Technologies (India) Ltd.

4.17%

The Federal Bank Ltd.

3.59%

Fortis Healthcare Ltd.

3.46%

|

| About Fund | ||||

| Fund Started Date | 28-Mar-2022 | 02-Jan-2013 | 13-Mar-2025 | 08-Oct-2024 |

| Fund Manager | Karthik Kumar | Shiv Chanani, Himanshu Singh | Alok Bahl, Pratik Singh | Abhishek Bisen, Devender Singhal, Satish Dondapati |

| Custodian Name | Deutsche Bank | Hongkong & Shanghai Banking Corporation | SBI SG Global Securities Services Pvt.Ltd. | Deutsche Bank |

| RTA Name | KFin Tech | KFin Tech | Cams | Cams |

| RTA Address | Karvy House, No. 46, 8-2-609/K, Avenue 4, Street No.1 Banjara Hills, | Karvy House, No. 46, 8-2-609/K, Avenue 4, Street No.1 Banjara Hills, | 7th Floor, Tower II, Rayala Towers, 158, Anna Salai, | 7th Floor, Tower II, Rayala Towers, 158, Anna Salai, |

| RTA Email | mfshyderabad@karvy.com | mfshyderabad@karvy.com | enq_h@camsonline.com | enq_h@camsonline.com |

| RTA Website | www.karvymfs.com | www.karvymfs.com | www.camsonline.com | www.camsonline.com |

You May Be Interested In

SBI Infrastructure Fund Direct Growth

SBI Mutual Fund • Sectoral

HSBC Infrastructure Fund Direct Growth

HSBC Mutual Fund • Sectoral

Invesco India Large & Mid Cap Fund Direct Growth

Invesco Mutual Fund • Large & MidCap

Sundaram Mid Cap Fund Direct Growth

Sundaram Mutual Fund • Mid Cap

Franklin India Prima Fund Direct Growth

Franklin Templeton Mutual Fund • Mid Cap

Axis Multicap Fund Direct Growth

Axis Mutual Fund • Multi Cap

Tata Banking and Financial Services Fund Direct Growth

Tata Mutual Fund • Sectoral

DSP Equity Opportunities Fund Direct Plan Growth

DSP Mutual Fund • Large & MidCap

DSP Equity Opportunities Fund Direct Plan Growth

DSP Mutual Fund • Large & MidCap

Motilal Oswal Nifty Midcap 150 Index Fund Direct Growth

Motilal Oswal Mutual Fund • Mid Cap