Alert

Your message here...

Empower your investments with advanced AI-driven tools that offer precision, speed, and smarter trading decisions. Leverage cutting-edge technology to enhance your market strategies, optimize performance, and achieve consistent, data-backed investment success.

Why Trade with

AIBull for Algo Trading?

AIBull is a leading algorithmic trading platform that uses advanced computer programs to empower traders, including pension funds and sell-side market participants. Our platform leverages high frequency trading (HFT) and algorithmic trading strategies to minimize human errors, offering real-time market analysis, automated trading, and personalized solutions compliant with securities and exchange regulations.

Learn more

Trade with AIBull

AIBull’s algorithmic trading platform uses AI-driven computer programs to help traders make informed decisions. Trading is a method of executing orders with precision, using tools like moving averages to analyze market trends, catering to both retail and institutional market participants, including sell-side traders and pension funds.

Learn more

Create custom courses and upload study materials tailored to your unique educational needs.

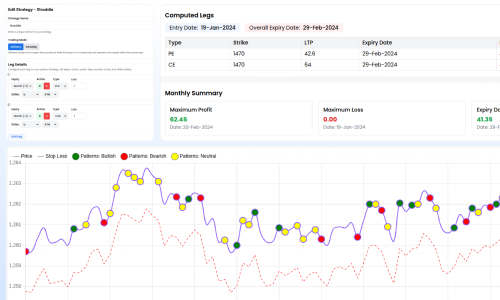

A tool designed to create, analyze, and manage options strategies through algorithmic models to optimize trading performance.

Allows traders to test their strategies against historical data to see how they would have performed in real market conditions before applying them live.

A high-frequency trading strategy that aims to capitalize on small price changes within short time frames. This tool automates quick trades to take advantage of market inefficiencies.

Leverage advanced AI to optimize strategies, automate trades, and gain real-time insights, empowering traders to enhance performance, reduce risk, and maximize profits in a dynamic market.

An intelligent assistant powered by artificial intelligence that can help you make trading decisions by providing real-time recommendations based on market trends and your portfolio.

A comprehensive dashboard to view and analyze your current investments and holdings, offering insights into their performance and risks.

Create custom courses and upload study materials tailored to your unique educational needs.

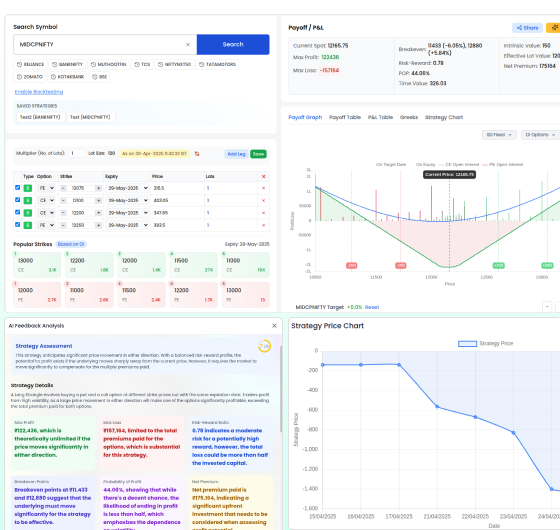

A trading strategy where a trader buys and sells options of the same class (call or put) on the same underlying asset but with different strike prices or expiration dates.

Displays a list of available options for a particular asset, showing their prices, expiration dates, and strike prices to help traders select appropriate contracts for trading.

Scans for straddle opportunities, where a trader buys both a call and a put option with the same strike price and expiration date, typically used when expecting high volatility.

Analyzes different spread strategies, providing insights into potential profits, risks, and the best combinations of options for a chosen strategy.

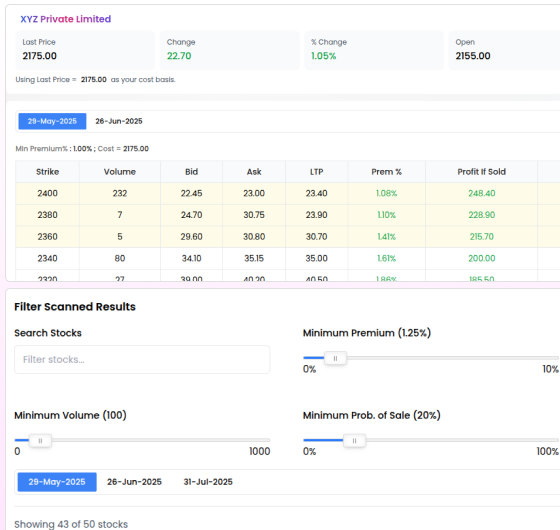

A tool that scans various strike prices for options to identify which ones may offer the best risk-to-reward ratio based on current market conditions.

AI-Powered Insights for Smarter, Safer Portfolio Management Decisions

AI analyzes historical returns and growth metrics to identify high-performing assets and detect overconcentration risks.

It assesses sector and stock diversity, recommending additions from underrepresented sectors to reduce volatility.

AI continuously tracks sector-specific and macroeconomic risks, issuing alerts for potential exposure to downturns.

Each stock is evaluated based on financials, technical indicators, and market sentiment to guide buy/hold/sell decisions.

AI suggests rebalancing actions, portfolio adjustments, and entry into emerging sectors for better long-term stability.

Create custom courses and upload study materials tailored to your unique educational needs.

A strategy where a trader holds a long position in an asset while simultaneously selling a call option on that asset to generate income from option premiums.

A strategy in which a trader sells a put option while ensuring they have enough cash in their account to purchase the underlying asset if the option is exercised.

A strategy in which a trader sells a put option while ensuring they have enough cash in their account to purchase the underlying asset if the option is exercised.

Create custom courses and upload study materials tailored to your unique educational needs.

A strategy involving the simultaneous buying and selling of futures contracts to profit from price differences between related markets or instruments.

A principle that states the price relationship between puts and calls with the same strike prices and expiration dates should remain in a balanced equilibrium, allowing traders to exploit discrepancies.

A market-neutral strategy that involves using four options (a combination of calls and puts) to lock in a risk-free profit from the price discrepancy between them.

Create custom courses and upload study materials tailored to your unique educational needs.

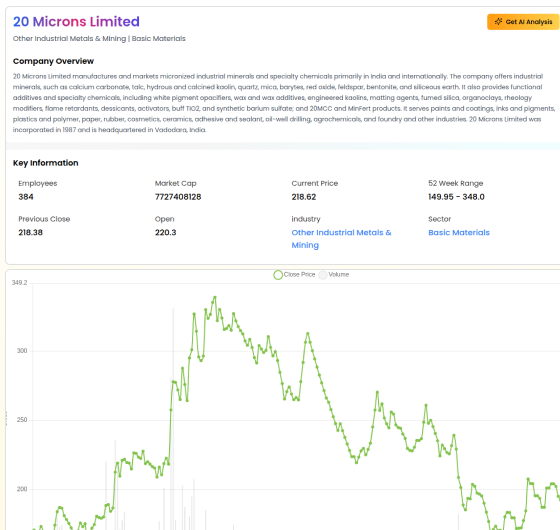

A tool that filters stocks based on predefined criteria such as market capitalization, sector, dividend yield, etc., to help traders find stocks that match their investment strategy.

Provides real-time analysis of stock performance, including trends, technical indicators, and news, helping traders make informed decisions based on live market data.

A market-neutral strategy that involves using four options (a combination of calls and puts) t]]]]]]0o lock in a risk-free profit from the price discrepancy between them.

Create custom courses and upload study materials tailored to your unique educational needs.

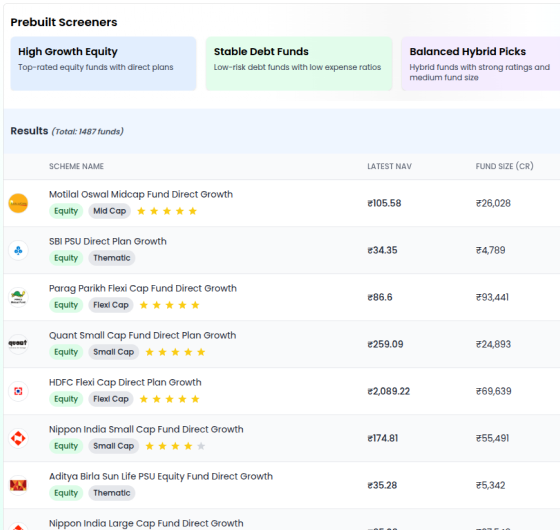

Filter mutual funds based on performance, expense ratio, asset allocation, and category to find options that align with your investment goals.

Compare mutual funds side-by-side based on performance, expense ratio, asset allocation, and other key metrics to make informed investment decisions.

Learn how The AI Bull transforms options trading with advanced AI tools, backtesting features, and intelligent market analysis. Check out our FAQs to get all your questions answered.

The AI Bull is an AI-powered trading platform designed to optimize options trading, backtesting, and market analysis with intelligent tools and strategies.

It provides real-time trading recommendations using machine learning algorithms, helping traders make informed decisions based on current market trends and portfolio data.

The platform offers strategies like Covered Calls, Cash Secured Put, and Expiration Day strategies, designed to maximize returns while managing risks.

Yes, the platform includes a backtesting tool that lets you test your strategies against historical data to see how they would have performed in live market conditions.

Yes, it includes features like Spread Analysis, Straddle Scanners, and Strike Scanners, which help in advanced options trading.

Futures Arbitrage is a strategy where price differences between related futures contracts are exploited for risk-free profits. Yes, The AI Bull offers this feature.

This tool lets you view and analyze your investments, monitor their performance, and receive insights into their risk levels with the help of AI analysis.

Yes, the platform’s stock screener allows you to filter stocks by various criteria like market cap, dividend yield, etc., tailored to your investment strategy.

The Live AI Agent is an AI assistant that provides real-time trading recommendations based on your portfolio and current market trends.

The AI Bull supports various arbitrage strategies like Box Spread Arbitrage and Exchanges Arbitrage, helping you profit from price discrepancies in markets or exchanges.

While primarily a trading platform, it provides in-depth resources for understanding different trading strategies and how AI tools can be applied in trading.

Although primarily designed for trading, The AI Bull tracks trading performance and provides detailed reports on your trading activities and strategy efficiency.

You can sign up directly on their website by creating an account with your email, phone number, or through existing social login options.

Yes, The AI Bull can be accessed through a web browser, and its responsive design ensures a smooth experience on both desktop and mobile devices.

Yes, customer support is available through their AI-powered assistance system, offering help with sales inquiries, technical support, and general questions.

Discover how AIBull has transformed the trading experience for our users.

"The AI-driven trading strategies from AIBull helped me optimize my options trading. It’s like having a personal advisor that works 24/7."

Investor

"I’ve seen incredible results after integrating AiBull’s backtesting into my strategy. It gave me the confidence to execute trades in real-time."

Trader

"AiBull’s scalping tool has completely changed how we approach high-frequency trading. It’s automated, fast, and incredibly efficient."

Hedge Fund Manager

"As a beginner, AiBull’s simple interface and powerful tools helped me understand complex trading strategies, improving my overall returns."

Retail Investor

"Using AiBull’s strike scanner has taken my options trading to the next level. It’s much faster and more efficient than any manual method."

Options Trader

"AiBull’s spread analyzer helps me identify the best strategies for bull and bear spreads with detailed insights and calculations."

Trader

"AIBull has helped me learn to trade smarter, and now I can confidently use cash-secured puts to generate passive income."

Investor

"The futures arbitrage tool has been a game-changer for me, helping me profit from price discrepancies with minimal risk."

Hedge Fund Analyst

"AiBull’s live AI agent gives me real-time trading advice that helps me make smarter decisions faster than I could on my own."

Day Trader

Discover how AI-powered trading tools can enhance your trading strategies, optimize performance, and boost decision-making with The AI Bull.

Debojyoti Roy

2024/09/14