Box Spread Arbitrage Scanner

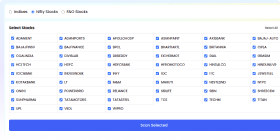

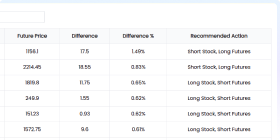

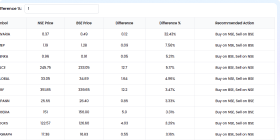

Indices

Most Active Stocks

Frequently Asked Questions

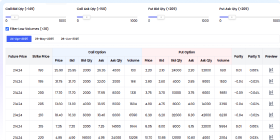

What is a Box Spread Arbitrage?

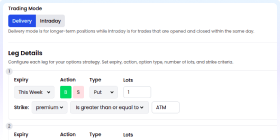

A box spread arbitrage is a trading strategy that involves creating a combination of options positions (long and short) with the same expiration, designed to lock in risk-free profits by exploiting pricing discrepancies.

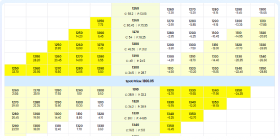

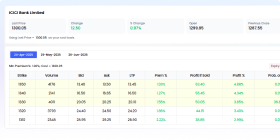

How does the scanner identify arbitrage opportunities?

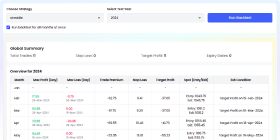

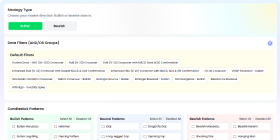

The scanner analyzes the prices of long and short call/put options with the same strike prices and expiration, identifying cases where the cost of entering the spread differs from the expected payoff, signaling potential arbitrage opportunities.

Can I use this scanner for any stock or index?

Yes, you can search for box spread arbitrage opportunities on individual stocks or indices. Simply enter a symbol or choose from popular stocks and indices.

What factors influence box spread arbitrage opportunities?

Key factors include pricing discrepancies, option premiums, and expiration dates. The scanner evaluates these factors to detect profitable arbitrage opportunities between long and short positions.

Are there risks associated with box spread arbitrage?

While box spreads can be risk-free theoretically, execution risks such as slippage, transaction costs, or liquidity issues may reduce profits. It's crucial to consider these factors when entering a box spread arbitrage trade.