Overview

Bandhan Innovation Fund Direct Growth

Bandhan Mutual Fund

The Scheme seeks to generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of companies following innovation theme.

Investments in Bandhan Innovation Fund Direct Growth are subject to market risks. Please read the offer document carefully before investing to understand the potential market risks and rewards.

Latest NAV

₹ 11.931

Fund Size (AUM)

₹1387.32 Cr

Risk

Very High (Risk rating: 6/10)

Minimum Investment

Lumpsum: ₹ 1000

SIP: ₹100

Launch Date

30-Apr-2024

Expense Ratio

0.57%

Exit Load

Exit load of 0.50%, if redeemed within 30 days.

Benchmark

NIFTY 500 Total Return Index

Standard Deviation

N/A

History

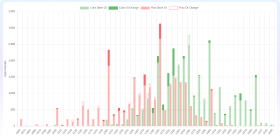

Performance & Ratios

1-Year SIP Return

1.41%

3-Year SIP Return

N/A

5-Year SIP Return

N/A

Mean Return

N/A

Alpha

-

Beta

-

Sharpe Ratio

-

Sortino Ratio

-

Information Ratio

-

Returns

| 1Y | 3Y | 5Y | All Time | |

|---|---|---|---|---|

| Fund Returns | N/A | N/A | N/A | N/A |

| Category Average | 5.23% | 17.08% | 27.03% | N/A |

| Rank Within Category | N/A | N/A | N/A | N/A |

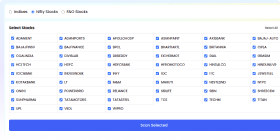

Holdings (71)

| Company | Sector | Instrument | Assets |

|---|---|---|---|

| Astrazeneca Pharma India Ltd. | Healthcare | Equity | 4.04% |

| Eternal Ltd. | Services | Equity | 3.59% |

| Bajaj Finserv Ltd. | Financial | Equity | 3.57% |

| One97 Communications Ltd. | Services | Equity | 3.55% |

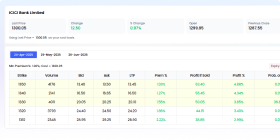

| ICICI Bank Ltd. | Financial | Equity | 3.25% |

| Varun Beverages Ltd. | Consumer Staples | Equity | 3.23% |

| Bharti Airtel Ltd. - (Partly Paid up Equity Shares (Rights Issue)) | Communication | PPE | 3.13% |

| Cholamandalam Investment and Finance Company Ltd. | Financial | Equity | 3.1% |

| Coforge Ltd. | Technology | Equity | 2.55% |

| Amber Enterprises India Ltd. | Consumer Discretionary | Equity | 2.24% |

Holdings Analysis

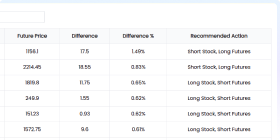

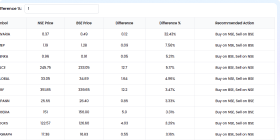

Peer Comparison

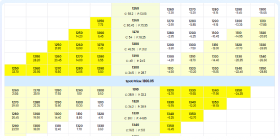

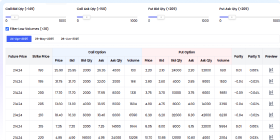

SIP, STP & SWP Details

Systematic Investment Plan (SIP):

Frequency: Monthly

Min Amount: ₹ 100

Multiplier: 1

Systematic Transfer Plan (STP):

Frequency: MONTHLY

Dates: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28

Min Amount: ₹ 500

Min Installments: 6

Systematic Withdrawal Plan (SWP):

Frequency: MONTHLY

Dates: Any day of the month

Min Amount: ₹ 200

Min Installments: 6

AMC Details

Asset Management Company

Bandhan Mutual Fund

IDFC Mutual Fund started their mutual fund on 13/03/2000 and its managing total assets of ₹66,620 Cr. Its ranked at 11 as per total assets at end of 30th Sep 2017. Bandhan Mutual Fund employs robust strategies to manage market risks, but investments remain subject to market risks. Please read the fund’s documentation for detailed risk management policies.

IDFC Mutual Fund works under the name IDFC Asset Management Company. The main objective of this mutual fund company is to grow the AUM of the company by offering adequate products for retail, as well as industrial customers.

IDFC is a relatively new fund house, but nevertheless, has won many accolades for its performance, from various agencies.

IDFC mutual fund offers a bunch of mutual fund schemes that have performed relatively well in the market and therefore, this fund house has carved a niche for itself.

It provides funds ranging from equity to debt to hybrid.

This AMC focuses on infrastructure as its key area and its main businesses in Project Finance, Principal Investments, Financial Markets and Investment Banking, Broking, Advisory Services and Asset Management.

IDFC effectively started off its business in 2000 and has since then been catering to investor needs by periodically improving its fund stature, holdings and policies.

Launch Date

1999-12-20T00:00:00.767Z

Total AUM

₹ 162760.69 Cr

Address

One World Centre, 6th Floor, Tower 1C,Senapati Bapat Marg, Prabhadevi Mumbai 400013

Phone

None

Website

Sub Type

Contra

Sub Type Info

Contra funds follow Contrarian strategy which means investing in stocks in contrast to the prevailing sentiment. Minimum investment in equity is 65%.

Tax Impact

Returns are taxed at 20%, if you redeem before one year. After 1 year, you are required to pay LTCG tax of 12.5% on returns of Rs 1.25 lakh+ in a financial year.

Stamp Duty

0.005% (from July 1st, 2020)

Fund Manager Details

Compare with Another Fund

Bandhan Innovation Fund Direct Growth

Bandhan Mutual Fund

You May Be Interested In

Bandhan Midcap Fund Direct Growth

Mid Cap

SBI Nifty India Consumption Index Fund Direct Growth

Thematic

JM Midcap Fund Direct Growth

Mid Cap

Tata Nifty India Digital ETF FoF Direct Growth

Sectoral

Edelweiss Nifty Smallcap 250 Index Fund Direct Growth

Small Cap

Kotak MNC Fund Direct Growth

Thematic

TRUSTMF Small Cap Fund Direct Growth

Small Cap

HDFC Non Cyclical Consumer Fund Direct Growth

Thematic

Motilal Oswal Nifty MidSmall Healthcare Index Fund Direct Growth

Sectoral

Tata Business Cycle Fund Direct Growth

Thematic

Explore More Mutual Funds

Debt Mutual Funds - Best Debt Fund Options

Discover top debt mutual funds for stable returns. Filter by NAV, fund size, and AMC to find the best debt funds for you.

Hybrid Mutual Funds - Top Hybrid Funds

Find top hybrid mutual funds for balanced growth. Filter by NAV, fund size, and risk to choose the best hybrid funds.

Commodities Mutual Funds

Explore commodities mutual funds for diversification. Filter by NAV and fund size to find the best commodity funds.

ELSS Mutual Funds - Top Tax-Saving Funds

Discover top ELSS mutual funds for tax savings and growth. Filter by NAV, fund size, and AMC to find the best ELSS funds.

Frequently Asked Questions

How is the overall rating calculated?

The overall rating for Bandhan Innovation Fund Direct Growth is an aggregate score based on performance metrics (returns over 1, 3, and 5 years), risk-adjusted returns (Sharpe and Sortino ratios), and consistency relative to its category. Ratings are on a scale of 1 to 5, with 5 being the highest.

What are the top stocks of Bandhan Innovation Fund Direct Growth?

The top stocks held by Bandhan Innovation Fund Direct Growth include Astrazeneca Pharma India Ltd., Eternal Ltd., Bajaj Finserv Ltd..

Which industries does Bandhan Innovation Fund Direct Growth invest in?

Bandhan Innovation Fund Direct Growth primarily invests in the following industries: Healthcare, Services, Financial.

Who are the fund managers of Bandhan Innovation Fund Direct Growth?

The fund managers of Bandhan Innovation Fund Direct Growth are Manish Gunwani and Brijesh Shah and Prateek Poddar and Ritika Behera and Gaurav Satra.

How many years has the fund manager been managing Bandhan Innovation Fund Direct Growth?

Manish Gunwani:

Calculating...

Brijesh Shah:

Calculating...

Prateek Poddar:

Calculating...

Ritika Behera:

Calculating...

Gaurav Satra:

Calculating...

What is the minimum investment for Bandhan Innovation Fund Direct Growth?

The minimum investment for Bandhan Innovation Fund Direct Growth is ₹1000 for lumpsum investments and ₹100 for SIPs.

What are the average 1-year returns for Bandhan Innovation Fund Direct Growth?

Calculating...

What are the average 3-year returns for Bandhan Innovation Fund Direct Growth?

Calculating...

What is the expense ratio of Bandhan Innovation Fund Direct Growth, and how does it compare to its category?

The expense ratio of Bandhan Innovation Fund Direct Growth is 0.57%. No category comparison data is available.