Overview

Kotak India EQ Contra Fund Direct Growth

Kotak Mahindra Mutual Fund

The scheme aims to generate capital appreciation from a diversified portfolio of equity and equity related instruments. It will invest in stocks of companies, which are fundamentally sound but are undervalued.

Investments in Kotak India EQ Contra Fund Direct Growth are subject to market risks. Please read the offer document carefully before investing to understand the potential market risks and rewards.

Latest NAV

₹ 165.771

Fund Size (AUM)

₹3934.53 Cr

Risk

Very High (Risk rating: 6/10)

Minimum Investment

Lumpsum: ₹ 100

SIP: ₹100

Launch Date

01-Jan-2013

Expense Ratio

0.6%

Exit Load

Exit load of 1% if redeemed within 90 days.

Benchmark

NIFTY 500 Total Return Index

Standard Deviation

14.88

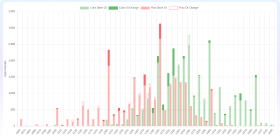

History

Performance & Ratios

1-Year SIP Return

-6.67%

3-Year SIP Return

19.91%

5-Year SIP Return

22.2%

Mean Return

13.64%

Alpha

5.55

Beta

0.98

Sharpe Ratio

0.89

Sortino Ratio

1.5

Information Ratio

1.75

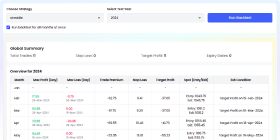

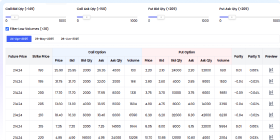

Returns

| 1Y | 3Y | 5Y | All Time | |

|---|---|---|---|---|

| Fund Returns | 10.36% | 20.64% | 29.23% | 15.95% |

| Category Average | 7.33% | 17.19% | 27.13% | N/A |

| Rank Within Category | 10 | 7 | 8 | N/A |

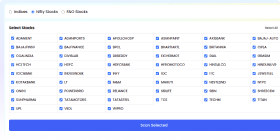

Holdings (61)

| Company | Sector | Instrument | Assets |

|---|---|---|---|

| HDFC Bank Ltd. | Financial | Equity | 6.52% |

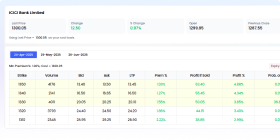

| ICICI Bank Ltd. | Financial | Equity | 6.1% |

| State Bank of India | Financial | Equity | 3.68% |

| Infosys Ltd. | Technology | Equity | 3.61% |

| Bharti Airtel Ltd. | Communication | Equity | 2.96% |

| Tech Mahindra Ltd. | Technology | Equity | 2.71% |

| Mphasis Ltd. | Technology | Equity | 2.67% |

| Axis Bank Ltd. | Financial | Equity | 2.45% |

| Reliance Industries Ltd. | Energy | Equity | 2.44% |

| Ultratech Cement Ltd. | Construction | Equity | 2.37% |

Holdings Analysis

Peer Comparison

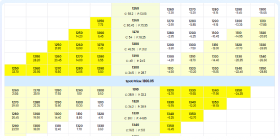

SIP, STP & SWP Details

Systematic Investment Plan (SIP):

Frequency: Monthly

Min Amount: ₹ 100

Multiplier: 1

Systematic Transfer Plan (STP):

Frequency: MONTHLY

Dates: Any day of the month

Min Amount: ₹ 1000

Min Installments: 6

Systematic Withdrawal Plan (SWP):

Frequency: MONTHLY

Dates: Any day of the month

Min Amount: ₹ 1000

Min Installments: 6

AMC Details

Asset Management Company

Kotak Mahindra Mutual Fund

Kotak Mahindra Mutual Fund started their mutual fund on 23/06/1998 and its managing total assets of ₹1,10,832 Cr. Its ranked at 7 as per total assets at end of 30th Sep 2017. Kotak Mahindra Mutual Fund employs robust strategies to manage market risks, but investments remain subject to market risks. Please read the fund’s documentation for detailed risk management policies.

Kotak Group is India's first NBFC. It has about 80 branches that offer mutual fund services. It also has overseas branches in Abu Dhabi, Dubai, London, New York, Texas, California and Singapore.

Kotak Group has a market capitalization of USD 26.98 Bn and around 46,000+ employees working under it. The asset management company offers various funds across different market capitalization for investors with varying risk appetite and ideal investment duration.

The vision of Kotak mutual funds is to be an ethical market player in the Indian mutual fund industry and it strives to offer the best products to its investors. Kotak has a legacy of many years and therefore, its brand value helps its products to stand-out in the market. The AMC has garnered over 10 lakh customers, within the span of 12 years.

Launch Date

1994-08-05T00:00:00.677Z

Total AUM

₹ 473887.31 Cr

Address

The Capital Building, Behind ICICI Bank, G Block BKC, Bandra Kurla ComplexBandra (E) Mumbai 400051

Phone

022-61152100 / 1800-22-2626

Website

Sub Type

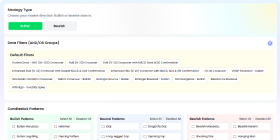

Contra

Sub Type Info

Contra funds follow Contrarian strategy which means investing in stocks in contrast to the prevailing sentiment. Minimum investment in equity is 65%.

Tax Impact

Returns are taxed at 20%, if you redeem before one year. After 1 year, you are required to pay LTCG tax of 12.5% on returns of Rs 1.25 lakh+ in a financial year.

Stamp Duty

0.005% (from July 1st, 2020)

Fund Manager Details

Compare with Another Fund

Kotak India EQ Contra Fund Direct Growth

Kotak Mahindra Mutual Fund

You May Be Interested In

Bandhan Sterling Value Fund Direct Plan Growth

Value Oriented

HDFC Large Cap Fund Direct Plan Growth

Large Cap

Baroda BNP Paribas Multi Cap Fund Direct Growth

Multi Cap

Sundaram Nifty 100 Equal Weight Fund Direct Growth

Large Cap

Edelweiss Large Cap Fund Direct Growth

Large Cap

Bank of India ELSS Tax Saver Direct Growth

ELSS

Aditya Birla Sun Life Frontline Equity Direct Fund Growth

Large Cap

DSP Top 100 Equity Direct Plan Growth

Large Cap

Invesco India Flexi Cap Fund Direct Growth

Flexi Cap

HSBC Value Fund Direct Growth

Value Oriented

Explore More Mutual Funds

Debt Mutual Funds - Best Debt Fund Options

Discover top debt mutual funds for stable returns. Filter by NAV, fund size, and AMC to find the best debt funds for you.

Hybrid Mutual Funds - Top Hybrid Funds

Find top hybrid mutual funds for balanced growth. Filter by NAV, fund size, and risk to choose the best hybrid funds.

Commodities Mutual Funds

Explore commodities mutual funds for diversification. Filter by NAV and fund size to find the best commodity funds.

ELSS Mutual Funds - Top Tax-Saving Funds

Discover top ELSS mutual funds for tax savings and growth. Filter by NAV, fund size, and AMC to find the best ELSS funds.

Frequently Asked Questions

How is the overall rating calculated?

The overall rating for Kotak India EQ Contra Fund Direct Growth is an aggregate score based on performance metrics (returns over 1, 3, and 5 years), risk-adjusted returns (Sharpe and Sortino ratios), and consistency relative to its category. Ratings are on a scale of 1 to 5, with 5 being the highest.

What are the top stocks of Kotak India EQ Contra Fund Direct Growth?

The top stocks held by Kotak India EQ Contra Fund Direct Growth include HDFC Bank Ltd., ICICI Bank Ltd., State Bank of India.

Which industries does Kotak India EQ Contra Fund Direct Growth invest in?

Kotak India EQ Contra Fund Direct Growth primarily invests in the following industries: Financial, Technology, Communication.

Who is the fund manager of Kotak India EQ Contra Fund Direct Growth?

The fund manager of Kotak India EQ Contra Fund Direct Growth is Shibani Sircar Kurian.

How many years has the fund manager been managing Kotak India EQ Contra Fund Direct Growth?

Shibani Sircar Kurian: Calculating...

What is the minimum investment for Kotak India EQ Contra Fund Direct Growth?

The minimum investment for Kotak India EQ Contra Fund Direct Growth is ₹100 for lumpsum investments and ₹100 for SIPs.

What are the average 1-year returns for Kotak India EQ Contra Fund Direct Growth?

Calculating...

What are the average 3-year returns for Kotak India EQ Contra Fund Direct Growth?

Calculating...

What is the expense ratio of Kotak India EQ Contra Fund Direct Growth, and how does it compare to its category?

The expense ratio of Kotak India EQ Contra Fund Direct Growth is 0.6%. No category comparison data is available.