Overview

Mirae Asset Equity Allocator FoF Direct Growth

Mirae Asset Mutual Fund

The scheme seeks to provide long-term capital appreciation from a portfolio investing predominantly in units of domestic equity ETFs.

Investments in Mirae Asset Equity Allocator FoF Direct Growth are subject to market risks. Please read the offer document carefully before investing to understand the potential market risks and rewards.

Latest NAV

₹ 23.784

Fund Size (AUM)

₹853.07 Cr

Risk

Very High (Risk rating: 6/10)

Minimum Investment

Lumpsum: ₹ 5000

SIP: ₹99

Launch Date

21-Sep-2020

Expense Ratio

0.06%

Exit Load

Exit load of 0.05% if redeemed within 5 days.

Benchmark

NIFTY 200 Total Return Index

Standard Deviation

14.42

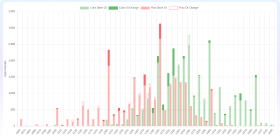

History

Performance & Ratios

1-Year SIP Return

-5.71%

3-Year SIP Return

13.55%

5-Year SIP Return

N/A

Mean Return

N/A

Alpha

0.31

Beta

1.02

Sharpe Ratio

0.52

Sortino Ratio

0.85

Information Ratio

0.25

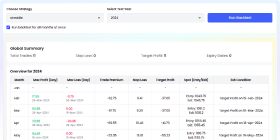

Returns

| 1Y | 3Y | 5Y | All Time | |

|---|---|---|---|---|

| Fund Returns | 9.01% | 14.39% | N/A | 95.84% |

| Category Average | 8.67% | 13.59% | 22.93% | N/A |

| Rank Within Category | 62 | 39 | N/A | N/A |

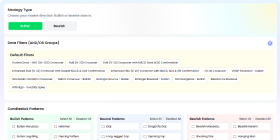

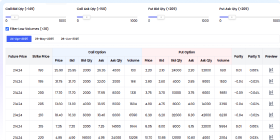

Holdings (3)

| Company | Sector | Instrument | Assets |

|---|---|---|---|

| Mirae Asset Nifty 50 ETF - Growth | None | Mutual Fund | 65.74% |

| Mirae Asset Nifty Midcap 150 ETF - Growth | None | Mutual Fund | 17.77% |

| Mirae Asset Nifty Next 50 ETF - Growth | None | Mutual Fund | 14.83% |

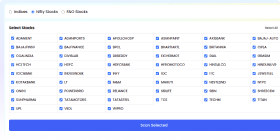

Holdings Analysis

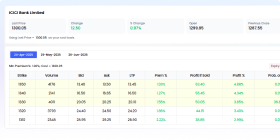

Peer Comparison

Peer Comparison

| Fund Name | AUM (₹ Cr) | 1Y Return (%) | 3Y Return (%) | Expense Ratio (%) | Rating |

|---|---|---|---|---|---|

| Nippon India Large Cap Fund Direct Growth | 37546.38 | 10.12 | 20.26 | 0.71 | N/A |

| ICICI Prudential Bluechip Fund Direct Growth | 64962.52 | 11.79 | 17.77 | 0.89 | N/A |

| Edelweiss Large Cap Fund Direct Growth | 1156.58 | 10.13 | 16.27 | 0.61 | N/A |

| Canara Robeco Bluechip Equity Fund Direct Growth | 14965.25 | 14.14 | 15.87 | 0.5 | N/A |

| Bandhan Large Cap Fund Direct Growth | 1765.87 | 12.16 | 15.86 | 0.9 | N/A |

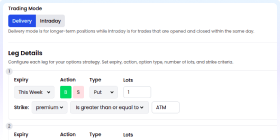

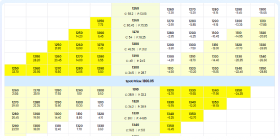

SIP, STP & SWP Details

Systematic Investment Plan (SIP):

Frequency: Monthly

Min Amount: ₹ 99

Multiplier: 1

Systematic Transfer Plan (STP):

Frequency: MONTHLY

Dates: 1, 10, 15, 21, 28

Min Amount: ₹ 1000

Min Installments: 5

Systematic Withdrawal Plan (SWP):

Frequency: MONTHLY

Dates: 1, 10, 15, 21, 28

Min Amount: ₹ 1000

Min Installments: 5

AMC Details

Asset Management Company

Mirae Asset Mutual Fund

Mirae Asset Mutual Fund started their mutual fund on 30/11/2007 and its managing total assets of ₹11,044 Cr. Its ranked at 22 as per total assets at end of 30th Sep 2017. Mirae Asset Mutual Fund employs robust strategies to manage market risks, but investments remain subject to market risks. Please read the fund’s documentation for detailed risk management policies.

Mirae Asset is a global financial company which is present across 12 countries and 5 continents. The company was founded in 1997 and since then pioneered to become a global presence.

Mirae believes that they are the best investment choice because of their strong investment philosophy, and niche to understand comparative advantage of various companies to make a sustainable and long- lasting decision for investors. They always believe in investing with a long term goal to sustainability in the market.

They believe in assessing risk in a way that it ultimately optimizes returns of investors. They constantly monitor the valuation, liquidity and corporate governance so that any risk can be mitigated. As a global brand it has obtained the trust of investors and has made a mark for itself in the mutual fund industry.

Launch Date

2007-11-30T00:00:00.591Z

Total AUM

₹ 183685.26 Cr

Address

Unit No.606 - 6th Floor,Windsor Building - Off. CST Road,Kalina, Santacruz (East), Mumbai 400098

Phone

022-67800301 / 1800-2090-777

Website

Sub Type

Contra

Sub Type Info

Contra funds follow Contrarian strategy which means investing in stocks in contrast to the prevailing sentiment. Minimum investment in equity is 65%.

Tax Impact

Returns are taxed at 20%, if you redeem before one year. After 1 year, you are required to pay LTCG tax of 12.5% on returns of Rs 1.25 lakh+ in a financial year.

Stamp Duty

0.005% (from July 1st, 2020)

Fund Manager Details

Compare with Another Fund

Mirae Asset Equity Allocator FoF Direct Growth

Mirae Asset Mutual Fund

You May Be Interested In

Canara Robeco Focused Equity Fund Direct Growth

Flexi Cap

Mahindra Manulife Focused Fund Direct Growth

Flexi Cap

Franklin India ELSS Tax Saver Fund Direct Growth

ELSS

Templeton India Value Fund Direct Plan Growth

Value Oriented

Canara Robeco Value Fund Direct Growth

Value Oriented

ICICI Prudential Nifty 100 Low Volatility 30 ETF FOF Direct Growth

Large Cap

ICICI Prudential Passive Strategy Fund (FOF) Direct Growth

Flexi Cap

Mahindra Manulife Large Cap Fund Direct Growth

Large Cap

Baroda BNP Paribas India Consumption Fund Direct Growth

Thematic

DSP ELSS Tax Saver Fund Direct Plan Growth

ELSS

Explore More Mutual Funds

Debt Mutual Funds - Best Debt Fund Options

Discover top debt mutual funds for stable returns. Filter by NAV, fund size, and AMC to find the best debt funds for you.

Hybrid Mutual Funds - Top Hybrid Funds

Find top hybrid mutual funds for balanced growth. Filter by NAV, fund size, and risk to choose the best hybrid funds.

Commodities Mutual Funds

Explore commodities mutual funds for diversification. Filter by NAV and fund size to find the best commodity funds.

ELSS Mutual Funds - Top Tax-Saving Funds

Discover top ELSS mutual funds for tax savings and growth. Filter by NAV, fund size, and AMC to find the best ELSS funds.

Mid Cap Equity Funds

Find top mid cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Small Cap Equity Funds

Find top small cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Multi Cap Equity Funds

Find top multi cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Flexi Cap Equity Funds

Find top flexi cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Frequently Asked Questions

How is the overall rating calculated?

The overall rating for Mirae Asset Equity Allocator FoF Direct Growth is an aggregate score based on performance metrics (returns over 1, 3, and 5 years), risk-adjusted returns (Sharpe and Sortino ratios), and consistency relative to its category. Ratings are on a scale of 1 to 5, with 5 being the highest.

What are the top stocks of Mirae Asset Equity Allocator FoF Direct Growth?

The top stocks held by Mirae Asset Equity Allocator FoF Direct Growth include Mirae Asset Nifty 50 ETF - Growth, Mirae Asset Nifty Midcap 150 ETF - Growth, Mirae Asset Nifty Next 50 ETF - Growth.

Which industries does Mirae Asset Equity Allocator FoF Direct Growth invest in?

Mirae Asset Equity Allocator FoF Direct Growth primarily invests in the following industries: None.

Who is the fund manager of Mirae Asset Equity Allocator FoF Direct Growth?

The fund manager of Mirae Asset Equity Allocator FoF Direct Growth is Bharti Sawant.

How many years has the fund manager been managing Mirae Asset Equity Allocator FoF Direct Growth?

Bharti Sawant: Calculating...

What is the minimum investment for Mirae Asset Equity Allocator FoF Direct Growth?

The minimum investment for Mirae Asset Equity Allocator FoF Direct Growth is ₹5000 for lumpsum investments and ₹99 for SIPs.

What are the average 1-year returns for Mirae Asset Equity Allocator FoF Direct Growth?

Calculating...

What are the average 3-year returns for Mirae Asset Equity Allocator FoF Direct Growth?

Calculating...

What is the expense ratio of Mirae Asset Equity Allocator FoF Direct Growth, and how does it compare to its category?

The expense ratio of Mirae Asset Equity Allocator FoF Direct Growth is 0.06%. The average expense ratio for similar funds in the Equity is Calculating....