Overview

UTI Focused Fund Direct Growth

UTI Mutual Fund

The scheme seeks to generate long term capital appreciation by investing in equity & equity related instruments of maximum 30 stocks across market caps.

Investments in UTI Focused Fund Direct Growth are subject to market risks. Please read the offer document carefully before investing to understand the potential market risks and rewards.

Latest NAV

₹ 15.7055

Fund Size (AUM)

₹2497.47 Cr

Risk

Very High (Risk rating: 6/10)

Minimum Investment

Lumpsum: ₹ 5000

SIP: ₹500

Launch Date

25-Aug-2021

Expense Ratio

0.69%

Exit Load

Exit load of 1% if redeemed within 365 days.

Benchmark

NIFTY 500 Total Return Index

Standard Deviation

14.38

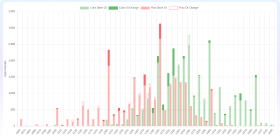

History

Performance & Ratios

1-Year SIP Return

-14.86%

3-Year SIP Return

12.06%

5-Year SIP Return

N/A

Mean Return

N/A

Alpha

2.52

Beta

0.92

Sharpe Ratio

0.68

Sortino Ratio

1.13

Information Ratio

0.38

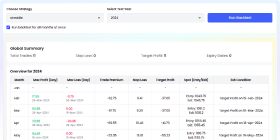

Returns

| 1Y | 3Y | 5Y | All Time | |

|---|---|---|---|---|

| Fund Returns | 10.03% | 16.68% | N/A | N/A |

| Category Average | 8.8% | 14.36% | 23.04% | N/A |

| Rank Within Category | 45 | 28 | N/A | N/A |

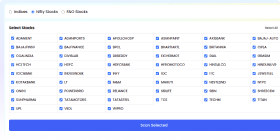

Holdings (29)

| Company | Sector | Instrument | Assets |

|---|---|---|---|

| HDFC Bank Ltd. | Financial | Equity | 9.99% |

| ICICI Bank Ltd. | Financial | Equity | 9.83% |

| Infosys Ltd. | Technology | Equity | 6.07% |

| Bharti Airtel Ltd. | Communication | Equity | 5.29% |

| Godrej Consumer Products Ltd. | Consumer Staples | Equity | 4.32% |

| Bajaj Finance Ltd. | Financial | Equity | 4.12% |

| Havells India Ltd. | Capital Goods | Equity | 3.88% |

| Avenue Supermarts Ltd. | Services | Equity | 3.65% |

| LTIMindtree Ltd. | Technology | Equity | 3.35% |

| Jubilant FoodWorks Ltd. | Services | Equity | 3.19% |

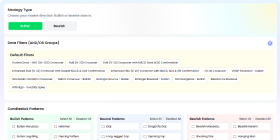

Holdings Analysis

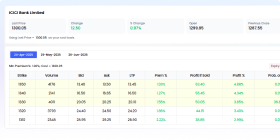

Peer Comparison

Peer Comparison

| Fund Name | AUM (₹ Cr) | 1Y Return (%) | 3Y Return (%) | Expense Ratio (%) | Rating |

|---|---|---|---|---|---|

| JM Flexicap Fund Direct Plan Growth | 5263.18 | 9.81 | 24.32 | 0.56 | N/A |

| HDFC Flexi Cap Direct Plan Growth | 69639.05 | 19.44 | 22.92 | 0.81 | N/A |

| Franklin India Flexi Cap Fund Direct Growth | 17393.86 | 13.23 | 18.89 | 1.0 | N/A |

| Parag Parikh Flexi Cap Fund Direct Growth | 93440.89 | 14.77 | 18.7 | 0.63 | N/A |

| HSBC Flexi Cap Fund Direct Growth | 4547.47 | 11.66 | 18.2 | 1.18 | N/A |

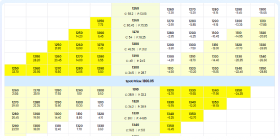

SIP, STP & SWP Details

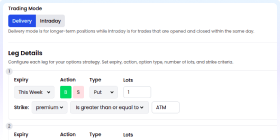

Systematic Investment Plan (SIP):

Frequency: Monthly

Min Amount: ₹ 500

Multiplier: 1

Systematic Transfer Plan (STP):

Frequency: MONTHLY

Dates: Any day of the month

Min Amount: ₹ 1000

Min Installments: 6

Systematic Withdrawal Plan (SWP):

Frequency: MONTHLY

Dates: Any day of the month

Min Amount: ₹ 500

Min Installments: 3

AMC Details

Asset Management Company

UTI Mutual Fund

UTI Mutual Fund started their mutual fund on 01/02/2003 and its managing total assets of ₹1,50,669 Cr. Its ranked at 6 as per total assets at end of 30th Sep 2017. UTI Mutual Fund employs robust strategies to manage market risks, but investments remain subject to market risks. Please read the fund’s documentation for detailed risk management policies.

UTI Mutual Fund was carved out of the erstwhile Unit Trust of India as a SEBI registered mutual fund from 1 February 2003. The Unit Trust of India Act 1963 was repealed, paving way for the bifurcation of UTI into – Specified Undertaking of Unit Trust of India; and UTI Mutual Fund. UTI AMC, India’s most trusted Wealth creators and always has the interest of its investors in its heart. The AMC has completed 50 years as India’s leading Financial service institution and was a sole vehicle of capital market investment for Indian Citizens till the early 90’s. The institution has shown great resilience and has grown from strength to strength overcoming economic turbulence and global turnarounds. This AMC has contributed immensely to industrial and capital growth in the Indian market. It has led transformative initiatives like developmental financial institutions, rural outreach programs and financial products and services.

Launch Date

2002-11-14T00:00:00.005Z

Total AUM

₹ 337639.69 Cr

Address

UTI Tower, Plot C-1, GN Block,Banrda Kurla Complex, Bandra (East) Mumbai 400051

Phone

0263 2296993

Website

Sub Type

Contra

Sub Type Info

Contra funds follow Contrarian strategy which means investing in stocks in contrast to the prevailing sentiment. Minimum investment in equity is 65%.

Tax Impact

Returns are taxed at 20%, if you redeem before one year. After 1 year, you are required to pay LTCG tax of 12.5% on returns of Rs 1.25 lakh+ in a financial year.

Stamp Duty

0.005% (from July 1st, 2020)

Fund Manager Details

Compare with Another Fund

UTI Focused Fund Direct Growth

UTI Mutual Fund

You May Be Interested In

Baroda BNP Paribas Banking and Financial Services Direct Growth

Sectoral

Franklin India Bluechip Fund Direct Growth

Large Cap

Mahindra Manulife Flexi Cap Fund Direct Growth

Flexi Cap

Kotak Focused Equity Fund Direct Growth

Flexi Cap

Motilal Oswal BSE Low Volatility Index Fund Direct Growth

Large & MidCap

PGIM India ELSS Tax Saver Fund Direct Growth

ELSS

Baroda BNP Paribas Focused Fund Direct Growth

Flexi Cap

HSBC Large Cap Fund Direct Growth

Large Cap

ITI Banking and Financial Services Fund Direct Growth

Sectoral

Edelweiss Nifty 100 Quality 30 Index Fund Direct Growth

Large Cap

Explore More Mutual Funds

Large Cap Equity Funds

Find top large cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Mid Cap Equity Funds

Find top mid cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Small Cap Equity Funds

Find top small cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Multi Cap Equity Funds

Find top multi cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Liquid Debt Funds

Find top liquid debt funds. Filter by AMC, NAV, and fund size to choose the best funds.

Low Duration Debt Funds

Find top low duration debt funds. Filter by AMC, NAV, and fund size to choose the best funds.

Corporate Bond Debt Funds

Find top corporate bond debt funds. Filter by AMC, NAV, and fund size to choose the best funds.

Aggressive Hybrid Funds

Find top aggressive hybrid funds. Filter by AMC, NAV, and fund size to choose the best funds.

Frequently Asked Questions

How is the overall rating calculated?

The overall rating for UTI Focused Fund Direct Growth is an aggregate score based on performance metrics (returns over 1, 3, and 5 years), risk-adjusted returns (Sharpe and Sortino ratios), and consistency relative to its category. Ratings are on a scale of 1 to 5, with 5 being the highest.

What are the top stocks of UTI Focused Fund Direct Growth?

The top stocks held by UTI Focused Fund Direct Growth include HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd..

Which industries does UTI Focused Fund Direct Growth invest in?

UTI Focused Fund Direct Growth primarily invests in the following industries: Financial, Technology, Communication.

Who are the fund managers of UTI Focused Fund Direct Growth?

The fund managers of UTI Focused Fund Direct Growth are Vishal Chopda and Deepesh Agarwal.

How many years has the fund manager been managing UTI Focused Fund Direct Growth?

Vishal Chopda:

Calculating...

Deepesh Agarwal:

Calculating...

What is the minimum investment for UTI Focused Fund Direct Growth?

The minimum investment for UTI Focused Fund Direct Growth is ₹5000 for lumpsum investments and ₹500 for SIPs.

What are the average 1-year returns for UTI Focused Fund Direct Growth?

Calculating...

What are the average 3-year returns for UTI Focused Fund Direct Growth?

Calculating...

What is the expense ratio of UTI Focused Fund Direct Growth, and how does it compare to its category?

The expense ratio of UTI Focused Fund Direct Growth is 0.69%. The average expense ratio for similar funds in the Equity is Calculating....