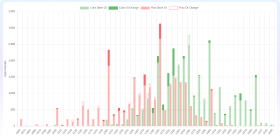

Stock Comparison Charts

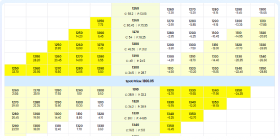

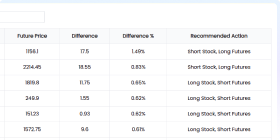

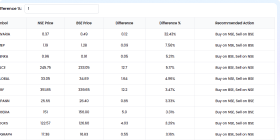

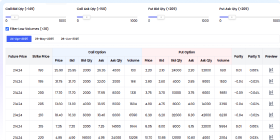

| Metric | ||||

|---|---|---|---|---|

| Stock Details | ||||

| Current Price | 99.69 | 113.49 | 29.95 | 2217.5 |

| Previous Close | 101.38 | 114.31 | 30.39 | 2149.8 |

| Open | 102.0 | 114.31 | 30.98 | 2185.0 |

| Day Low | 98.85 | 112.89 | 29.88 | 2176.2 |

| Day High | 102.38 | 114.5 | 30.98 | 2241.5 |

| Market Cap | 1071906816000.0 | 1039972368384.0 | 11821235200.0 | 4408944361472.0 |

| P/E Ratio | 14.04 | 5.87 | 12.64 | 19.91 |

| Forward P/E | 20.34 | 6.0 | N/A | 17.48 |

| Earnings Per Share | 7.1 | 19.34 | 2.37 | 111.36 |

| Dividend Yield (%) | 2.03 | 3.5 | N/A | 0.09 |

| Beta | 0.07 | 0.61 | 0.08 | 0.36 |

| EBITDA | N/A | N/A | N/A | N/A |

| Book Value | 57.27 | 116.22 | 40.92 | 792.12 |

| Debt to Equity | N/A | N/A | N/A | N/A |

| ROCE (%) | N/A | N/A | N/A | N/A |

| ROE (%) | N/A | N/A | N/A | N/A |

| Face Value | N/A | N/A | N/A | N/A |

| Price to Book | 1.74 | 0.98 | 0.73 | 2.8 |

| Performance | ||||

| 1Y Return (%) | 1844.84 | -145.69 | -2757.39 | 1634.06 |

| About Company | ||||

| Founded Year | N/A | N/A | N/A | N/A |

| Employees | N/A | 81260 | N/A | N/A |

| Website | Live Website of IDBI | Live Website of CANBK | Live Website of DHANBANK | Live Website of KOTAKBANK |

Company Overviews & Financial Position

Review detailed company profiles, including business summaries and key insights into their balance sheet and company financial position to aid in buying or selling decisions.

IDBI Bank Limited

IDBI Bank Limited provides a range of banking and financial services in India. It operates through three segments: Treasury, Retail Banking, and Corporate/Wholesale Banking. The Treasury segment include investments, money market operations, derivative trading, and foreign exchange operations. The Retail Banking segment provides credit and deposit services; and ATMs, POS machines, Internet banking, mobile banking, travel/currency cards, and transaction banking services. The Corporate/Wholesale Banking segment provides deposit and credit services, corporate advisory/syndication, and project appraisal. The company also offers savings, current, and salary accounts, as well as fixed deposits; home, auto, education, and personal loans, as well as loans against properties and securities; debit, credit, and prepaid cards; and investment advisory and capital market services. The company was formerly known as IDBI Ltd. and changed its name to IDBI Bank Limited in May 2008. IDBI Bank Limited was founded in 1964 and is headquartered in Mumbai, India.

Canara Bank

Canara Bank provides various banking products and services in India and internationally. It offers deposits and accounts, such as savings accounts, current accounts, recurring deposits, and term deposits; unclaimed deposits; loan products, including home, vehicle, education, personal, mortgage, gold, MSME, agri, and solar loans; life, general, and health insurance products; corporate loans comprising working capital, infrastructure, and export finance products, as well as term loans; depository services, merchant banking, and online trading services; and mutual funds. The company also provides digital lending portal; mobile and internet banking; credit, debit, and prepaid cards; UPI and fastag; missed call banking; online account opening services; and payment solutions; NRI banking accounts; remittance facilities; attorneyship service; and nomination facility. In addition, it offers supply chain finance management; syndication services; IPO monitoring services; locker services; doorstep banking services; and consultancy services, which includes estate and wills, private and charitable trustee, debenture and security trusteeship, and attorney services. Canara Bank was incorporated in 1906 and is headquartered in Bengaluru, India.

Dhanlaxmi Bank Limited

Dhanlaxmi Bank Limited provides various banking and financial services in India. It operates through Treasury Operations, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business Operations segments. The company offers deposit products, such as savings and current accounts, and term deposits; loans, including personal, home, new and used car, two wheeler, commercial, gold, education, business, and green loans, as well as loans against securities and properties, and lease rental discounting; and foreign exchange services comprising foreign currency cash, cheque deposits, foreign currency demand drafts, and remittances. It also provides export and import services; credit products comprising industrial and trade advance, import export assistance, and agricultural assistance; corporate salary accounts; credit treasury bills and linked loans; trade finance, electronic bank guarantees, and liberalized remittance schemes; 3 in 1 trading accounts; and mutual funds investment services, as well as life, health, and car insurance products. In addition, the company offers non-resident Indians (NRI) banking services, such as non-residential external accounts, non-resident ordinary accounts, recurring and term deposits, foreign currency non-resident fixed deposits, and resident foreign currency accounts, as well as money transfer services and NRI property loans; and micro and agricultural banking, and financial planning services. Further, it provides SME banking services, including working capital facilities, trade facilities, and capacity expansion services; credit, debit, and gift cards; retail and corporate net, mobile phone, and SMS banking; online services, such as bill payment, unified payments interface, mobile/DTH/data card recharges, missed call, shopping, positive pay, online trading, and custom duty online payments; and depository services, as well as safe deposit lockers. Dhanlaxmi Bank Limited was incorporated in 1927 and is based in Thrissur, India.

Kotak Mahindra Bank Limited

Kotak Mahindra Bank Limited provides a range of banking and financial services to corporate and individual customers in India. It operates through Treasury, BMU and Corporate Centre; Retail Banking; Corporate / Wholesale Banking; Digital Banking; Other Retail Banking; Vehicle Financing; Other Lending Activities; Broking; Advisory and Transactional Services; Asset Management; and Insurance segments. The company offers savings, current, and salary accounts; fixed, recurring, tax saving fixed, senior citizen, and fixed deposit products; home, personal, business, payday, gold, education, commercial vehicle, car, and crop loans, as well as loan against securities and properties; construction equipment, farm equipment, healthcare, trade and supply chain, and working capital finance solutions; and prepaid, credit, and debit cards. It also provides Investment products; life, term, health, car, and two wheeler insurance; payment services; trade services; business management and marketing, enterprise resource planning, supply chain and logistics, human resource, business travel, workspace management, taxation and legal, and healthcare/medical equipment services; cash management services, such as digital payments, physical collections, digital collections, and payment gateways; private banking services; net banking; and NRI services. Kotak Mahindra Bank Limited was incorporated in 1985 and is based in Mumbai, India.

Start Investing Today

Use a demat account and trading account to start buying or selling stocks in the stock market. Compare share prices and analyze financial statements to make informed investment decisions.

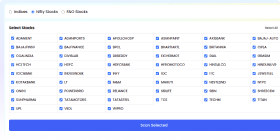

You May Be Interested In

HDFC Bank Limited

Financial Services • Banks - Regional

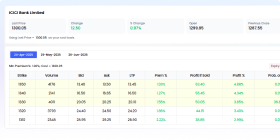

ICICI Bank Limited

Financial Services • Banks - Regional

State Bank of India

Financial Services • Banks - Regional

Axis Bank Limited

Financial Services • Banks - Regional

Punjab National Bank

Financial Services • Banks - Regional

Bank of Baroda Limited

Financial Services • Banks - Regional

Union Bank of India

Financial Services • Banks - Regional

Indian Bank

Financial Services • Banks - Regional

Indian Overseas Bank

Financial Services • Banks - Regional

IndusInd Bank Limited

Financial Services • Banks - Regional