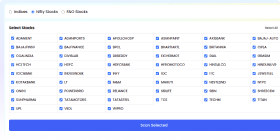

Stock Comparison Charts

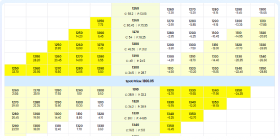

| Metric | ||||

|---|---|---|---|---|

| Stock Details | ||||

| Current Price | 90.76 | 313.05 | 432.15 | 59.8 |

| Previous Close | 90.19 | 312.2 | 427.2 | 59.48 |

| Open | 90.98 | 312.15 | 423.0 | 60.1 |

| Day Low | 90.0 | 308.3 | 419.75 | 59.36 |

| Day High | 91.6 | 315.3 | 437.8 | 60.58 |

| Market Cap | 975887859712.0 | 97585504256.0 | 183633494016.0 | 34890846208.0 |

| P/E Ratio | 12.31 | 14.57 | 59.85 | 101.36 |

| Forward P/E | 18.52 | N/A | 8.97 | N/A |

| Earnings Per Share | 7.37 | 21.48 | 7.22 | 0.59 |

| Dividend Yield (%) | 2.33 | 0.96 | N/A | N/A |

| Beta | 0.09 | 0.39 | 0.49 | 0.5 |

| EBITDA | N/A | N/A | N/A | N/A |

| Book Value | 59.24 | 81.12 | 292.38 | 49.76 |

| Debt to Equity | N/A | 37.34 | 376.17 | 17.62 |

| ROCE (%) | N/A | N/A | N/A | N/A |

| ROE (%) | N/A | N/A | N/A | N/A |

| Face Value | N/A | N/A | N/A | N/A |

| Price to Book | 1.53 | 3.86 | 1.48 | 1.2 |

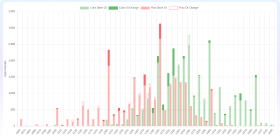

| Performance | ||||

| 1Y Return (%) | -455.07 | -587.88 | 54.13 | 2001.61 |

| About Company | ||||

| Founded Year | N/A | N/A | N/A | N/A |

| Employees | N/A | N/A | 14782 | N/A |

| Website | Live Website of IDBI | Live Website of IIFLCAPS | Live Website of IIFL | Live Website of DHANI |

Company Overviews & Financial Position

Review detailed company profiles, including business summaries and key insights into their balance sheet and company financial position to aid in buying or selling decisions.

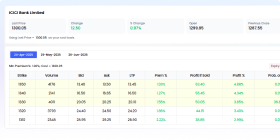

IDBI Bank Limited

IDBI Bank Limited provides banking and financial solutions to retail and corporate customers in India. It operates through three segments: Corporate/Wholesale Banking, Retail Banking, and Treasury Operations. The company offers savings, current, and salary accounts, as well as fixed deposits; home, auto, education, and personal loans, as well as loans against properties and securities; debit, credit, and prepaid cards; mobile and Internet banking; and investment advisory and capital market services. It also provides fund and non-fund-based assistance; packing credit to exporters; receivable buyout with recourse; channel financing for dealers of corporates; scheme for financing automated teller machines/cash dispense vendors; technology upgrading fund scheme for textile and jute industries; and lending to non-banking finance companies/housing finance companies and commercial real estate sector. In addition, the company offers bank guarantees, letters of credit, documentary collection, and bill discounting services; cash management, trade finance, and remittance services; and debt syndication and advisory services. Further, it provides finance to micro, small, and medium enterprises; agriculture finance; products and services for non-resident Indians; treasury services, such as call money/ notice money / term money, commercial papers, certificate of deposit, government securities, treasury bills, corporate bonds, and equities; and foreign currency services comprising remittances, currency forward contracts, LTFX, FX-retail, currency options, swaps, FRA, currency exchange, and exchange traded derivative contracts. The company was formerly known as IDBI Ltd. and changed its name to IDBI Bank Limited in May 2008. IDBI Bank Limited was founded in 1964 and is headquartered in Mumbai, India.

IIFL Capital Services Limited

IIFL Capital Services Limited provides capital market services in the primary and secondary markets in India. The company offers equity, commodities, and currency broking; depository participant services, mutual funds, bonds; broking, corporate access, and research support services; investment and trading across asset classes, including equity, commodity, derivatives, currency, margin trading funding. It also provides investment banking services consisting of initial public offerings, qualified institutional placement, right issues, preferential placement, follow-on public offer, share buybacks, tender offers, and delisting services; and advisory services for private equity placements, and mergers and acquisitions. In addition, the company distributes third-party financial products, such as mutual funds, insurance, portfolio management services, alternate investment funds, fixed income, and healthcare products. Further, it provides in-depth insight for asset allocation, market dynamics, wealth management, and investment strategies; and operates a mobile trading application under the IIFL Markets brand name. It serves retail, mass affluent, wealth investors, domestic and foreign institutional investors, sovereign wealth funds, international portfolio investors, mutual funds, insurance companies, banks, pension funds, non-resident individuals, high net worth individuals, alternate investment funds, and corporates. The company was formerly known as IIFL Securities Limited and changed its name to IIFL Capital Services Limited in November 2024. IIFL Capital Services Limited was incorporated in 1996 and is based in Mumbai, India.

IIFL Finance Limited

IIFL Finance Limited, a non-banking financial company, provides financial services in India and internationally. The company offers home and gold loans; business loans, including business loans for manufacturers, women, and e-commerce; loans to micro, small, and medium enterprises; loans against securities; and digital finance loans, as well as supply chain finance. It also provides construction and real estate financing; capital market financing; and lending, investment, and wealth management services. The company was formerly known as IIFL Holdings Limited and changed its name to IIFL Finance Limited in May 2019. IIFL Finance Limited was incorporated in 1995 and is headquartered in Mumbai, India.

Dhani Services Limited

Dhani Services Limited engages in the real estate development, broking, financing and digital wallet services, asset reconstruction, e-commerce, and related activities through its Dhani app in India. The company provides personal loans, business instalment loans, etc.; and sells pharmaceutical products. In addition, the company offers card enabled prepaid payment program management and remittance services. Further, it engages in the provision of stock and commodity broking services; business of cross selling of real estate; and asset reconstruction business of stressed assets, as well as securitization and other ancillary services. The company was formerly known as Indiabulls Ventures Limited and changed its name to Dhani Services Limited in October 2020. Dhani Services Limited was incorporated in 1995 and is based in Mumbai, India.

Start Investing Today

Use a demat account and trading account to start buying or selling stocks in the stock market. Compare share prices and analyze financial statements to make informed investment decisions.

You May Be Interested In

Kotak Mahindra Bank Limited

Financial Services • Banks - Regional

Axis Bank Limited

Financial Services • Banks - Regional

Bank of Baroda Limited

Financial Services • Banks - Regional

Punjab National Bank

Financial Services • Banks - Regional

Union Bank of India

Financial Services • Banks - Regional

Canara Bank

Financial Services • Banks - Regional

Indian Bank

Financial Services • Banks - Regional

Indian Overseas Bank

Financial Services • Banks - Regional

IndusInd Bank Limited

Financial Services • Banks - Regional

Yes Bank Limited

Financial Services • Banks - Regional