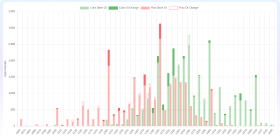

Stock Comparison Charts

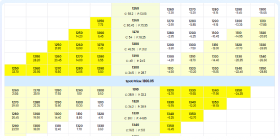

| Metric | ||||

|---|---|---|---|---|

| Stock Details | ||||

| Current Price | 99.69 | 2217.5 | 33.8 | 487.1 |

| Previous Close | 101.38 | 2149.8 | 34.27 | 491.95 |

| Open | 102.0 | 2185.0 | 34.29 | 494.0 |

| Day Low | 98.85 | 2176.2 | 33.8 | 487.0 |

| Day High | 102.38 | 2241.5 | 34.35 | 494.0 |

| Market Cap | 1071906816000.0 | 4408944361472.0 | 17768523776.0 | 51439710208.0 |

| P/E Ratio | 14.04 | 19.91 | N/A | 10.22 |

| Forward P/E | 20.34 | 17.48 | N/A | 6.13 |

| Earnings Per Share | 7.1 | 111.36 | -10.13 | 47.67 |

| Dividend Yield (%) | 2.03 | 0.09 | 2.16 | N/A |

| Beta | 0.07 | 0.36 | N/A | N/A |

| EBITDA | N/A | N/A | N/A | N/A |

| Book Value | 57.27 | 792.12 | 37.88 | 392.25 |

| Debt to Equity | N/A | N/A | N/A | N/A |

| ROCE (%) | N/A | N/A | N/A | N/A |

| ROE (%) | N/A | N/A | N/A | N/A |

| Face Value | N/A | N/A | N/A | N/A |

| Price to Book | 1.74 | 2.8 | 0.89 | 1.24 |

| Performance | ||||

| 1Y Return (%) | 1844.84 | 1634.06 | -3388.0 | -2624.44 |

| About Company | ||||

| Founded Year | N/A | N/A | N/A | N/A |

| Employees | N/A | N/A | N/A | N/A |

| Website | Live Website of IDBI | Live Website of KOTAKBANK | Live Website of ESAFSFB | Live Website of JSFB |

Company Overviews & Financial Position

Review detailed company profiles, including business summaries and key insights into their balance sheet and company financial position to aid in buying or selling decisions.

IDBI Bank Limited

IDBI Bank Limited provides a range of banking and financial services in India. It operates through three segments: Treasury, Retail Banking, and Corporate/Wholesale Banking. The Treasury segment include investments, money market operations, derivative trading, and foreign exchange operations. The Retail Banking segment provides credit and deposit services; and ATMs, POS machines, Internet banking, mobile banking, travel/currency cards, and transaction banking services. The Corporate/Wholesale Banking segment provides deposit and credit services, corporate advisory/syndication, and project appraisal. The company also offers savings, current, and salary accounts, as well as fixed deposits; home, auto, education, and personal loans, as well as loans against properties and securities; debit, credit, and prepaid cards; and investment advisory and capital market services. The company was formerly known as IDBI Ltd. and changed its name to IDBI Bank Limited in May 2008. IDBI Bank Limited was founded in 1964 and is headquartered in Mumbai, India.

Kotak Mahindra Bank Limited

Kotak Mahindra Bank Limited provides a range of banking and financial services to corporate and individual customers in India. It operates through Treasury, BMU and Corporate Centre; Retail Banking; Corporate / Wholesale Banking; Digital Banking; Other Retail Banking; Vehicle Financing; Other Lending Activities; Broking; Advisory and Transactional Services; Asset Management; and Insurance segments. The company offers savings, current, and salary accounts; fixed, recurring, tax saving fixed, senior citizen, and fixed deposit products; home, personal, business, payday, gold, education, commercial vehicle, car, and crop loans, as well as loan against securities and properties; construction equipment, farm equipment, healthcare, trade and supply chain, and working capital finance solutions; and prepaid, credit, and debit cards. It also provides Investment products; life, term, health, car, and two wheeler insurance; payment services; trade services; business management and marketing, enterprise resource planning, supply chain and logistics, human resource, business travel, workspace management, taxation and legal, and healthcare/medical equipment services; cash management services, such as digital payments, physical collections, digital collections, and payment gateways; private banking services; net banking; and NRI services. Kotak Mahindra Bank Limited was incorporated in 1985 and is based in Mumbai, India.

ESAF Small Finance Bank

ESAF Small Finance Bank provides banking products and services to retail, rural, and corporate customers in India. It operates through Treasury, Wholesale Banking, Retail Banking, and Other Banking segments. The company offers savings, current, and NRI accounts; foreign currency non-resident deposit accounts; fixed, recurring, social, and term deposits; personal net, mobile, SMS, missed call, and USSD banking services; and debit and credit cards. It also provides working capital/term, farmer interest group, used and new car, two- and three-wheeler, light commercial vehicle, school, personal, agri gold, lease rental discounting, global career development, dream education, gold, dairy development, MSME, dream home, affordable housing, clean energy, business, micro housing, income generation, general, microfinance, QR, micro enterprise, and other loans; as well as ESAF FPO finance; trade receivables e-discounting system; salary overdrafts; and loans against property. In addition, the company offers micro-banking services; internet bill payment system and unified payment interface services; investment products, including national pension systems; third party financial product distribution, such as life, general, and health insurance, as well as 3-in-1 accounts; treasury services; foreign exchange services comprising purchase and sale of currencies, outward and inward remittances, money transfer service schemes, and non-resident repatriation; and other banking services. The company was founded in 1992 and is based in Thrissur, India. ESAF Small Finance Bank is a subsidiary of ESAF Financial Holdings Private Limited.

Jana Small Finance Bank Limited

Jana Small Finance Bank Limited provides various banking products and services to individuals and enterprises in India. It operates through Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Operations segments. The company offers current and savings accounts; fixed, recurring, and other deposits; and loans, such as two-wheeler, group, business, gold, home improvement, agri group and individual, and home loans, as well as consumer education on loan overdue concepts. It also offers life, general, and health insurance products; cards; and investment and payment services, as well as mobile, internet, and corporate internet banking services. The company was formerly known as Janalakshmi Financial Services Limited and changed its name to Jana Small Finance Bank Limited in March 2018. The company was founded in 1999 and is headquartered in Bengaluru, India.

Start Investing Today

Use a demat account and trading account to start buying or selling stocks in the stock market. Compare share prices and analyze financial statements to make informed investment decisions.

You May Be Interested In

HDFC Bank Limited

Financial Services • Banks - Regional

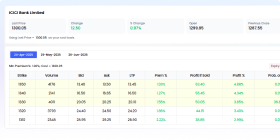

ICICI Bank Limited

Financial Services • Banks - Regional

State Bank of India

Financial Services • Banks - Regional

Axis Bank Limited

Financial Services • Banks - Regional

Punjab National Bank

Financial Services • Banks - Regional

Bank of Baroda Limited

Financial Services • Banks - Regional

Union Bank of India

Financial Services • Banks - Regional

Canara Bank

Financial Services • Banks - Regional

Indian Bank

Financial Services • Banks - Regional

Indian Overseas Bank

Financial Services • Banks - Regional