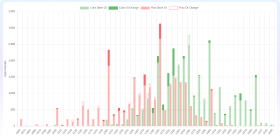

Stock Comparison Charts

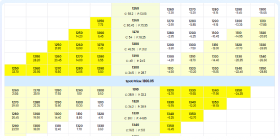

| Metric | ||||

|---|---|---|---|---|

| Stock Details | ||||

| Current Price | 30.27 | 114.6 | 280.8 | 292.8 |

| Previous Close | 30.0 | 114.56 | 279.85 | 296.55 |

| Open | 30.05 | 114.26 | 279.8 | 297.0 |

| Day Low | 29.83 | 113.84 | 279.15 | 292.8 |

| Day High | 30.4 | 114.85 | 281.0 | 297.9 |

| Market Cap | 80252428288.0 | 535808835584.0 | 12816581632.0 | 24366346240.0 |

| P/E Ratio | 6.08 | 5.47 | 9.66 | 26.4 |

| Forward P/E | 6.7 | 11.19 | 6.52 | 22.03 |

| Earnings Per Share | 4.98 | 20.96 | 29.08 | 11.09 |

| Dividend Yield (%) | 0.97 | 3.42 | 1.37 | N/A |

| Beta | 0.08 | 0.86 | N/A | 0.58 |

| EBITDA | N/A | N/A | N/A | N/A |

| Book Value | 38.67 | 177.27 | 296.18 | 89.94 |

| Debt to Equity | N/A | N/A | N/A | N/A |

| ROCE (%) | N/A | N/A | N/A | N/A |

| ROE (%) | N/A | N/A | N/A | N/A |

| Face Value | N/A | N/A | N/A | N/A |

| Price to Book | 0.78 | 0.65 | 0.95 | 3.26 |

| Performance | ||||

| 1Y Return (%) | 1295.18 | -740.38 | -2230.7 | -146.2 |

| About Company | ||||

| Founded Year | N/A | N/A | N/A | N/A |

| Employees | N/A | 50564 | 2059 | N/A |

| Website | Live Website of SOUTHBANK | Live Website of BANKINDIA | Live Website of CAPITALSFB | Live Website of FINOPB |

Company Overviews & Financial Position

Review detailed company profiles, including business summaries and key insights into their balance sheet and company financial position to aid in buying or selling decisions.

The South Indian Bank Limited

The South Indian Bank Limited provides various banking products and services in India. It operates through Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Operations segments. The company's personal banking products and services include savings and current accounts, term deposits, and unclaimed deposits/inoperative accounts; personal, car, home, gold, educational, property, and other loans, as well as one time settlement scheme for micro and small enterprises sector; and mutual funds. It also offers insurance products, such as life, health, and various credit risk insurance, as well as general insurance products, such as fire, liability, marine, motor, personal accident, and travel insurance products. In addition, the company provides money transfer services; various cards; and value added services, including SIB rewardz, KYC certification of mutual fund investors, SIB e-academia, 3-in-one trading KIT, green pin, SIB feebook, branch banking, FX-retail, KYC updation, NETC FASTag, sovereign gold bonds, credit and debit cards, ATM cum shopping card, mobile and internet banking, demat, pension system, online trading, APY/NPS lite, SIB collect, SIB travel card, PAN service agency, cash management, direct debit, tax payment and savings investments, and safe deposit locker services, as well as distributes capital gain bonds and tax free bonds. The company's NRI banking services comprise NRE and NRO rupee accounts, and foreign currency deposits; e-services; remittances and payments; money transfers; and value added services, as well as portfolio investment schemes. Its business banking services include normal and premium accounts, SIB merchant plus, and trader smart current accounts; working capital, long term, non-fund based, supply chain, and SIB commercial vehicle loans; international finance; and merchant acquiring services. It has a network of branches and ATMs/CRMs. The company was incorporated in 1929 and is headquartered in Thrissur, India.

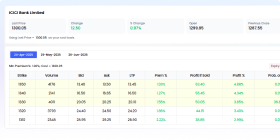

Bank of India Limited

Bank of India Limited provides various banking products and services in India and internationally. It operates through Treasury, Wholesale Banking, and Retail Banking segments. The company accepts various deposit products, such as savings, salary, current, term, and rera account deposits. It also provides debit, credit, and prepaid cards; personal, home, vehicle, education, star reverse mortgage, and home loans, as well as loans against property; and finance to new and existing business, healthcare schemes, govt. sponsored schemes, and commercial vehicle finance services. In addition, the company offers credit, cash management, and trade finance services; government deposit schemes, including public provident fund, senior citizens savings, Sukanya Samridhi, national pension system, departmentalized ministries, sovereign and RBI bond, mahila samman savings certificate, and other schemes; mutual funds; and life, health, and general insurance products. Further, it provides NRI services, such as accounts, loans, and money remittance and ancillary services, as well as Kisan credit card, gold loans, self help group, Atmanirbhar schemes, tractor/farm mechanization, food and agro loans, agri allied activities, Kisan Ghar and agri mortgage loan, agri clinic/agri business centers, and other loans services, as well as internet and mobile banking, and payment services. The company was incorporated in 1906 and is headquartered in Mumbai, India.

Capital Small Finance Bank Limited

Capital Small Finance Bank Limited provides a range of banking and financial products and services for individuals and businesses in India. It operates through Treasury, Wholesale Banking, Retail Banking, and Other Banking Operations segments. The company provides savings, current, and real estate regulatory authority accounts; term deposits; bank lockers; debit cards; trade finance; bank guarantees; 3-in-1 Demat Cum trading account; ATMs; cheque and pass books; and atal pension yojana scheme. It also provides loans, such as loan against rentals, auto, housing, gold, personal, mortgage loan against property, Kisan credit card, corporate lending, and MSME loans, as well as offers day national rural livelihood mission and national urban livelihoods mission, pradhan mantri kaushal vikas yojana, rural self-employment training institutes, and social security schemes. In addition, the company offers various insurance products, such as general, life, health, motor, travel, home, vehicle, commercial, term, whole life, children's education, money back and unit-linked insurance plans, savings, guaranteed return, and retirement plans. Additionally, it provides money transfer, E-hub education solutions, bill payment system, payment gateway, net banking, tax payments, and foreign exchange, government banking, and point of sale services. Further, the company offers NRI banking services. The company was formerly known as Capital Local Area Bank Limited and changed its name to Capital Small Finance Bank Limited in April 2016. Capital Small Finance Bank Limited was incorporated in 1999 and is headquartered in Jalandhar, India.

Fino Payments Bank Limited

Fino Payments Bank Limited provides various types of financial services in India. It operates through four segments: Treasury, Corporate Banking, Retail Banking, and Other Banking Operations. The company offers savings and current accounts, sweep account facility, fixed deposit services, and loan referral services; and debit and prepaid cards. It also provides recharge, bill payment, payment system, cash management, digital payment, merchant, and domestic money transfer services; mobile banking services; FASTag products; unified payments interface facility; remittances; and cash bazar, AADHAAR seeding, and micro ATM services. In addition, the company offers health, life, motor, and shopkeeper insurance products; and third party financial products distribution and business correspondent banking services. The company was formerly known as Fino Fintech Limited and changed its name to Fino Payments Bank Limited in April 2017. Fino Payments Bank Limited was founded in 2006 and is based in Navi Mumbai, India. Fino Payments Bank Limited operates as a subsidiary of FINO PayTech Limited.

Start Investing Today

Use a demat account and trading account to start buying or selling stocks in the stock market. Compare share prices and analyze financial statements to make informed investment decisions.

You May Be Interested In

Indian Overseas Bank

Financial Services • Banks - Regional

IndusInd Bank Limited

Financial Services • Banks - Regional

Yes Bank Limited

Financial Services • Banks - Regional

AU Small Finance Bank Limited

Financial Services • Banks - Regional

IDFC First Bank Limited

Financial Services • Banks - Regional

The Federal Bank Limited

Financial Services • Banks - Regional

Bank of Maharashtra

Financial Services • Banks - Regional

UCO Bank

Financial Services • Banks - Regional

Central Bank of India

Financial Services • Banks - Regional

Bandhan Bank Limited

Financial Services • Banks - Regional