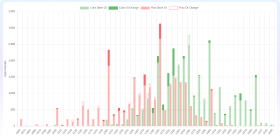

Stock Comparison Charts

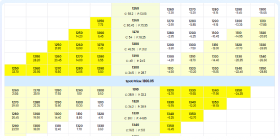

| Metric | ||||

|---|---|---|---|---|

| Stock Details | ||||

| Current Price | 134.79 | 1177.0 | 191.0 | 147.32 |

| Previous Close | 135.7 | 1173.8 | 190.39 | 143.74 |

| Open | 134.65 | 1179.0 | 191.71 | 143.82 |

| Day Low | 133.76 | 1166.9 | 190.54 | 143.82 |

| Day High | 135.18 | 1179.0 | 191.71 | 147.36 |

| Market Cap | 14568910848.0 | 3655420870656.0 | 73175539712.0 | 1189989056512.0 |

| P/E Ratio | 12.54 | 13.06 | 5.68 | 6.24 |

| Forward P/E | 4.65 | 11.27 | 5.15 | 8.44 |

| Earnings Per Share | 10.75 | 90.15 | 33.62 | 23.62 |

| Dividend Yield (%) | N/A | 0.08 | 2.81 | 3.09 |

| Beta | 0.11 | 0.51 | 0.67 | 0.96 |

| EBITDA | N/A | N/A | N/A | N/A |

| Book Value | 181.41 | 604.5 | 319.56 | 148.99 |

| Debt to Equity | N/A | N/A | N/A | N/A |

| ROCE (%) | N/A | N/A | N/A | N/A |

| ROE (%) | N/A | N/A | N/A | N/A |

| Face Value | N/A | N/A | N/A | N/A |

| Price to Book | 0.74 | 1.95 | 0.6 | 0.99 |

| Performance | ||||

| 1Y Return (%) | -2658.91 | -1022.22 | -1554.74 | 327.63 |

| About Company | ||||

| Founded Year | N/A | N/A | N/A | N/A |

| Employees | N/A | 104453 | N/A | N/A |

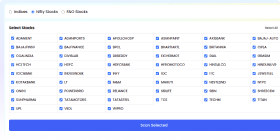

| Website | Live Website of SURYODAY | Live Website of AXISBANK | Live Website of KTKBANK | Live Website of UNIONBANK |

Company Overviews & Financial Position

Review detailed company profiles, including business summaries and key insights into their balance sheet and company financial position to aid in buying or selling decisions.

Suryoday Small Finance Bank Limited

Suryoday Small Finance Bank Limited operates as a small finance bank primarily serving the unserved and underserved with a focus on financial inclusion in India. It operates through Treasury, Retail Banking, Corporate Banking/Wholesale, and Other Banking Operation segments. The company accepts savings and current accounts, term and fixed deposits, and recurring deposits. It also provides finance for mortgage and commercial vehicles; micro finance loans; working capital and personal loans; and loans to micro, small, and medium enterprises, as well as loans to non-banking finance companies. In addition, the company offers home, secured business, joint liability group, two-wheeler, and individual loans; and emergency credit line guarantee schemes. Further, it provides debit cards; NRI banking services; internet, phone, and mobile banking services, as well as other digital payment solutions; life and general insurance services; and social security schemes. The company was incorporated in 2008 and is based in Navi Mumbai, India.

Axis Bank Limited

Axis Bank Limited, together with its subsidiaries, engages in the provision of various banking and financial products and services. It operates through four segments: Treasury, Retail Banking, Corporate/Wholesale Banking, and Other Banking Business. The Treasury segment is involved in investments in sovereign and corporate debt, and equity and mutual funds, trading operations, derivative trading, and foreign exchange operations, as well as central funding unit. The Retail Banking segment engages in the provision of lending services to individuals/small businesses; liability products, such as savings and current accounts, fixed deposits, recurring deposits, and other deposit options; retail lending products; credit, debit, and forex cards; internet banking, mobile banking, and ATM services; retail term deposits; financial advisory services; non-resident Indians services; bill payment and wealth management services; and distribution of third-party product, such as life and non-life insurance, mutual funds, government bonds, etc. The Corporate/Wholesale Banking segment offers corporate advisory, placements and syndication, project appraisals, loans, current and corporate term deposits, payments, trade finance products, letter of credits, bank guarantees, commercial cards, cash management, project appraisals, and capital market related services. The Other Banking Business segment is involved in para banking activities. It also engages in investments, broking, asset management, and trustee service and payment activities; and operation of MSME digital invoice discounting platform. The company operates branches; ATMs; and recyclers in India. The company was formerly known as UTI Bank Limited and changed its name to Axis Bank Limited in July 2007. Axis Bank Limited was incorporated in 1993 and is headquartered in Mumbai, India.

The Karnataka Bank Limited

The Karnataka Bank Limited provides various banking and financial services in India. It operates through Corporate/Wholesale Banking, Retail Banking, Treasury, and Other Banking Operations segments. The Corporate/Wholesale Banking segment provides various fund and non-fund-based products, including term loans, working capital facilities, foreign exchange services, structured finance, and trade financing products. The Retail Banking segment offers home, automobile, personal, and education loans; loans against term deposits; loans against securities; and gold, small business, and agriculture loans to agriculture, MSME, housing, and education sectors. Its products include KBL Contractor Mitra, KBL Micro Mitra, KBL Export Mitra, KBL MSME, as well as KBL Mahila Udyog for financial support of women entrepreneurs. The Treasury segment engages in statutory reserves management, such as SLR and CRR; liquidity management; investment and trading activities; and foreign exchange activities. It also invests in sovereign debt instruments and other fixed income securities; mutual funds; certificates of deposits; floating rate instrument; forward contracts; and trades debt and equity securities, and foreign exchange. The Other Banking Operations segment offers a range of ancillary products and services, including depository; online trading; ASBA, locker, and safe custody facilities; bill payment; online and off-line fee collection; mobile and internet banking; and payment and remittance services, as well as FASTag services. It provides its services through physical banking channels, digital channels, including inter alia, internet and mobile banking, and e-lobbies. In addition, the company distributes insurance products. The Karnataka Bank Limited was incorporated in 1924 and is based in Mangalore, India.

Union Bank of India

Union Bank of India provides various banking products and services. It operates through four segments: Treasury Operations, Retail Banking Operations, Corporate and Wholesale Banking, and Other Banking Operations. The company offers savings and current accounts; term deposits; home, vehicle, education, personal, agriculture, and gold loans; loans against the property; and loans for senior citizen and pensioners, as well as products and loans for micro, small, and medium enterprises. It also provides mutual funds; life, non-life, and health insurance products; demat and online trading services; tax saving deposits; government saving schemes; and safe deposit locker and cheque collection services. In addition, the company offers corporate loans, that includes export scheme, line of credit, trade finance, working capital, project financing, and channel finance; debt structuring/restructuring, loan syndication, and structured finance services; cash management, ECGC cover, and foreign exchange services, as well as derivatives; export and import finance services; NRI banking services; and treasury and other products, and remittance services. Further, it provides app, internet, self-service, ATM, and SMS banking services; point of sale terminal and immediate payment services; and debit, credit, gift, and payroll cards. The company was incorporated in 1919 and is headquartered in Mumbai, India.

Start Investing Today

Use a demat account and trading account to start buying or selling stocks in the stock market. Compare share prices and analyze financial statements to make informed investment decisions.

You May Be Interested In

HDFC Bank Limited

Financial Services • Banks - Regional

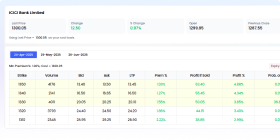

ICICI Bank Limited

Financial Services • Banks - Regional

State Bank of India

Financial Services • Banks - Regional

Kotak Mahindra Bank Limited

Financial Services • Banks - Regional

Punjab National Bank

Financial Services • Banks - Regional

Bank of Baroda Limited

Financial Services • Banks - Regional

IDBI Bank Limited

Financial Services • Banks - Regional

Canara Bank

Financial Services • Banks - Regional

Indian Bank

Financial Services • Banks - Regional

Indian Overseas Bank

Financial Services • Banks - Regional