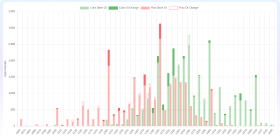

Stock Comparison Charts

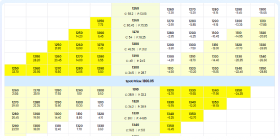

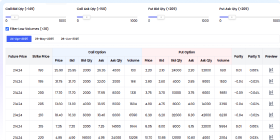

| Metric | ||||

|---|---|---|---|---|

| Stock Details | ||||

| Current Price | 24.15 | 33.06 | 49.03 | 30.08 |

| Previous Close | 24.16 | 32.82 | 49.12 | 30.29 |

| Open | 24.16 | 33.14 | 49.02 | 30.25 |

| Day Low | 24.02 | 32.95 | 48.72 | 30.05 |

| Day High | 24.24 | 33.39 | 49.5 | 30.45 |

| Market Cap | 26933770240.0 | 234580213760.0 | 94890205184.0 | 11891977216.0 |

| P/E Ratio | 109.77 | 22.04 | 13.22 | 12.69 |

| Forward P/E | 5.77 | N/A | 8.12 | N/A |

| Earnings Per Share | 0.22 | 1.5 | 3.71 | 2.37 |

| Dividend Yield (%) | 2.04 | 0.61 | 3.06 | N/A |

| Beta | N/A | 0.36 | 0.44 | 0.08 |

| EBITDA | N/A | N/A | N/A | N/A |

| Book Value | 30.07 | 17.55 | 31.44 | 40.92 |

| Debt to Equity | N/A | N/A | N/A | N/A |

| ROCE (%) | N/A | N/A | N/A | N/A |

| ROE (%) | N/A | N/A | N/A | N/A |

| Face Value | N/A | N/A | N/A | N/A |

| Price to Book | 0.8 | 1.88 | 1.56 | 0.74 |

| Performance | ||||

| 1Y Return (%) | -5276.64 | -4446.7 | 954.51 | -2904.66 |

| About Company | ||||

| Founded Year | N/A | N/A | N/A | N/A |

| Employees | N/A | N/A | 24374 | N/A |

| Website | Live Website of UTKARSHBNK | Live Website of PSB | Live Website of UJJIVANSFB | Live Website of DHANBANK |

Company Overviews & Financial Position

Review detailed company profiles, including business summaries and key insights into their balance sheet and company financial position to aid in buying or selling decisions.

Utkarsh Small Finance Bank Limited

Utkarsh Small Finance Bank Limited provides banking and financial services in India. The company offers savings account, and fixed, recurring, and tax saver fixed deposits; debit, credit, and other cards; home, LAP retail, personal, gold, and other loans; life and general insurance; investment products; and remittance, bill payment, locker facility, overdraft facility against fixed deposits, ATM and branch banking, corporate net banking, and internet and mobile banking services. It also provides current, institutional, and escrow banking accounts; micro banking group, MSME, wholesale, micro banking business, commercial vehicle and construction equipment, and other loans; life, health, and general insurance; various investment products; and inward and outward remittance, bill payment, ATM, and internet and mobile banking services for business customers. The company was founded in 2009 and is based in Varanasi, India. Utkarsh Small Finance Bank Limited is a subsidiary of Utkarsh CoreInvest Limited.

Punjab & Sind Bank

Punjab & Sind Bank provides various banking and financial products and services in India. The company operates through four segments: Treasury Operations, Corporate/Wholesale Banking, Digital Banking and Other Retail Banking, and Other Banking Operations. It offers deposit products, including saving accounts, current accounts, salary PLUS accounts, saving bank deposit accounts, smart business flexi current scheme accounts, recurring deposit accounts, fixed deposits, tax saver, flexi savings deposit and special fixed deposit. The company also provides loan products, home, auto, skill education, commercial vehicle, personal, doctor, mortgage, vyapar, gold, Mudra, MSME, and agri loans; and SME liquid plus and contractor plus products, as well as sukhmoney for senior citizens, and SB OD and central sector interest subsidiary schemes. The company also provides non fund based products, including letter of credit, LC advising/confirming, bank guarantee, co-acceptance facility, solvency certificate, and credit report products and services, as well as debt restructuring services. In addition, it offers locker facility, government schemes, and life, general, and health insurance services; digital banking services comprising internet and mobile banking, SMS banking, Aadhaar seeding and pay, point of sale, unified payment interface, BBPS, IMPS/USSD, RTGS/NEFT, ATM/debit cards, and online payment; international banking services, including NRI schemes, export/import services, forex treasury, residential facilities, and gold card scheme; and social banking, as well as products for micro and small enterprises and applications supported by blocked amount services for investors. The company was incorporated in 1908 and is headquartered in New Delhi, India.

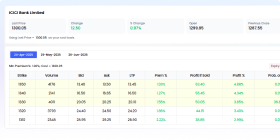

Ujjivan Small Finance Bank Limited

Ujjivan Small Finance Bank Limited provides various banking and financial services in India. The company operates through Treasury, Retail Banking, and Corporate/Wholesale Banking segments. It provides current, savings, salary, TACS savings and current, and NRI accounts; and fixed, recurring, TASC fixed, NRI and NRO fixed, and tax saver fixed deposits. The company's loan products include home and micro mortgages, including home purchase and home construction, composite (plot purchase and self-construction) home, home improvement, and home equity loans; micro mortgages, business loan, and loan against property; vehicle loans, such as two-wheeler loan, electric three-wheeler loan, and dealer trade advance; micro loans, including group and individual loans; agricultural loans; micro, small, and medium enterprises loans and overdrafts; and gold and staff loans. In addition, it provides mobile, personal net, SMS and missed call, phone, video, and WhatsApp banking; ATMs and cash deposit machines; statements services; life, health, and general insurances; credit and debit cards; and safe deposit lockers. Additionally, the company is involved in retail forex and trade. Ujjivan Small Finance Bank Limited was incorporated in 2016 and is headquartered in Bengaluru, India.

Dhanlaxmi Bank Limited

Dhanlaxmi Bank Limited provides various banking and financial services in India. It operates through Treasury Operations, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business Operations segments. The company offers deposit products, such as savings and current accounts, and term deposits; loans, including personal, home, new and used car, two wheeler, commercial, gold, education, business, and green loans, as well as loans against securities and properties, and lease rental discounting; and foreign exchange services comprising foreign currency cash, cheque deposits, foreign currency demand drafts, and remittances. It also provides export and import services; credit products comprising industrial and trade advance, import export assistance, and agricultural assistance; corporate salary accounts; credit treasury bills and linked loans; trade finance, electronic bank guarantees, and liberalized remittance schemes; 3 in 1 trading accounts; and mutual funds investment services, as well as life, health, and car insurance products. In addition, the company offers non-resident Indians (NRI) banking services, such as non-residential external accounts, non-resident ordinary accounts, recurring and term deposits, foreign currency non-resident fixed deposits, and resident foreign currency accounts, as well as money transfer services and NRI property loans; and micro and agricultural banking, and financial planning services. Further, it provides SME banking services, including working capital facilities, trade facilities, and capacity expansion services; credit, debit, and gift cards; retail and corporate net, mobile phone, and SMS banking; online services, such as bill payment, unified payments interface, mobile/DTH/data card recharges, missed call, shopping, positive pay, online trading, and custom duty online payments; and depository services, as well as safe deposit lockers. Dhanlaxmi Bank Limited was incorporated in 1927 and is based in Thrissur, India.

Start Investing Today

Use a demat account and trading account to start buying or selling stocks in the stock market. Compare share prices and analyze financial statements to make informed investment decisions.

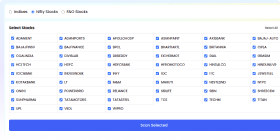

You May Be Interested In

The Federal Bank Limited

Financial Services • Banks - Regional

Bank of Maharashtra

Financial Services • Banks - Regional

UCO Bank

Financial Services • Banks - Regional

Central Bank of India

Financial Services • Banks - Regional

Bandhan Bank Limited

Financial Services • Banks - Regional

The Karur Vysya Bank Limited

Financial Services • Banks - Regional

City Union Bank Limited

Financial Services • Banks - Regional

RBL Bank Limited

Financial Services • Banks - Regional

The Jammu and Kashmir Bank Limited

Financial Services • Banks - Regional

The South Indian Bank Limited

Financial Services • Banks - Regional