Overview

Franklin India Debt Hybrid Fund A Direct Growth

Franklin Templeton Mutual Fund

The Scheme seeks to provide regular income through a portfolio of predominantly fixed income securities with a maximum with a maximum exposure of 20% to equities. exposure of 25% to equities.

Investments in Franklin India Debt Hybrid Fund A Direct Growth are subject to market risks. Please read the offer document carefully before investing to understand the potential market risks and rewards.

Latest NAV

₹ 97.7076

Fund Size (AUM)

₹198.28 Cr

Risk

Moderately High (Risk rating: 4/10)

Minimum Investment

Lumpsum: ₹ 10000

SIP: ₹500

Launch Date

01-Jan-2013

Expense Ratio

0.65%

Exit Load

Nil

Benchmark

CRISIL Hybrid 85+15 Conservative Index

Standard Deviation

3.82

History

Performance & Ratios

1-Year SIP Return

7.89%

3-Year SIP Return

10.95%

5-Year SIP Return

9.97%

Mean Return

6.58%

Alpha

1.4

Beta

0.88

Sharpe Ratio

0.82

Sortino Ratio

1.49

Information Ratio

0.93

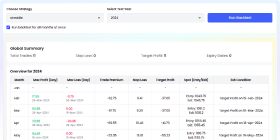

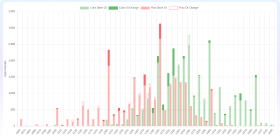

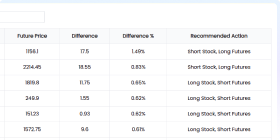

Returns

| 1Y | 3Y | 5Y | All Time | |

|---|---|---|---|---|

| Fund Returns | 10.68% | 10.19% | 10.74% | 9.49% |

| Category Average | 9.72% | 8.93% | 10.18% | N/A |

| Rank Within Category | 12 | 13 | 17 | N/A |

Holdings (70)

| Company | Sector | Instrument | Assets |

|---|---|---|---|

| Bajaj Finance Ltd. | Financial | Debenture | 7.73% |

| REC Ltd. | Financial | Bonds | 5.5% |

| Bajaj Housing Finance Ltd. | Financial | Debenture | 5.46% |

| Mankind Pharma Ltd. | Healthcare | Bonds/Deb | 5.27% |

| Mahindra Rural Housing Finance Ltd. | Financial | Debenture | 5.13% |

| Small Industries Devp. Bank of India Ltd. | Financial | Debenture | 5.09% |

| National Bank For Agriculture & Rural Development | Financial | Bonds | 5.08% |

| Kotak Mahindra Investments Ltd. | Financial | Debenture | 2.72% |

| Mahindra & Mahindra Financial Services Ltd. | Financial | Bonds | 2.71% |

| GOI | Sovereign | GOI Sec | 2.64% |

Holdings Analysis

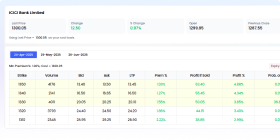

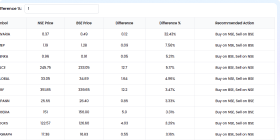

Peer Comparison

Peer Comparison

| Fund Name | AUM (₹ Cr) | 1Y Return (%) | 3Y Return (%) | Expense Ratio (%) | Rating |

|---|---|---|---|---|---|

| Kotak Debt Hybrid Fund Direct Growth | 3017.08 | 12.14 | 12.0 | 0.45 | N/A |

| Parag Parikh Conservative Hybrid Fund Direct Growth | 2451.46 | 11.34 | 11.75 | 0.35 | N/A |

| HDFC Hybrid Debt Fund Direct Growth | 3309.97 | 10.55 | 11.22 | 1.15 | N/A |

| ICICI Prudential Regular Savings Fund Direct Growth | 3127.42 | 10.92 | 10.56 | 0.97 | N/A |

| SBI Conservative Hybrid Fund Direct Growth | 9666.02 | 10.32 | 10.31 | 1.05 | N/A |

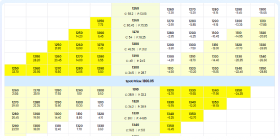

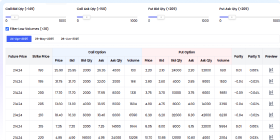

SIP, STP & SWP Details

Systematic Investment Plan (SIP):

Frequency: Monthly

Min Amount: ₹ 500

Multiplier: 1

Systematic Transfer Plan (STP):

Frequency: MONTHLY

Dates: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28

Min Amount: ₹ 1000

Min Installments: 2

Systematic Withdrawal Plan (SWP):

Frequency: MONTHLY

Dates: Any day of the month

Min Amount: ₹ 500

Min Installments: 1

AMC Details

Asset Management Company

Franklin Templeton Mutual Fund

Franklin Templeton Mutual Fund started their mutual fund on 19/02/1996 and its managing total assets of ₹95,716 Cr. Its ranked at 8 as per total assets at end of 30th Sep 2017. Franklin Templeton Mutual Fund employs robust strategies to manage market risks, but investments remain subject to market risks. Please read the fund’s documentation for detailed risk management policies.

The firm specializes in conservatively managed mutual funds. It offers products under the Franklin, Templeton, Mutual Series and Fiduciary brand names. Like other large investment companies, the firm offers a wide variety of funds but is traditionally best known for bond funds under the Franklin brand, international funds under the Templeton brand, and value funds under the Mutual Series brand.

With more than 600 investment professionals in 28 countries around the world, Franklin Templeton is uniquely positioned to look beyond the largest or most visible securities in each market to spot smart global investments that meet their rigorous investment criteria.

Franklin Templeton's association with India dates back to over 2 decades as an investor. As part of the group's major thrust on investing in markets around the world, the India office was set up in 1996 as Templeton Asset Management India Pvt. Limited.

Launch Date

1996-02-19T00:00:00.459Z

Total AUM

₹ 106403.1 Cr

Address

Unit No.202/203/204, 2nd Floor Dalamal Tower, Plot No. 211Free Press Journal Marg, Nariman Point Mumbai 400013

Phone

1800-425-4255 / 60004255

Sub Type

Gilt

Sub Type Info

Invest predominantly in Government Securities(minimum 80% of total assets). They are relatively more risky than the other debt funds due to fluctuating interest rates.

Tax Impact

Returns are taxed as per your Income Tax slab.

Stamp Duty

0.005% (from July 1st, 2020)

Fund Manager Details

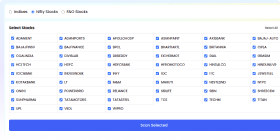

Compare with Another Fund

Franklin India Debt Hybrid Fund A Direct Growth

Franklin Templeton Mutual Fund

You May Be Interested In

Mirae Asset Equity Savings Fund Direct Growth

Equity Savings

Bandhan Arbitrage Fund Direct Growth

Arbitrage

Tata Retirement Savings Fund Moderate Plan Direct Growth

Aggressive Hybrid

Sundaram Conservative Hybrid Fund Direct Plan Growth

Conservative Hybrid

DSP Arbitrage Fund Direct Growth

Arbitrage

Invesco India Balanced Advantage Fund Direct Growth

Dynamic Asset Allocation

UTI Arbitrage Fund Direct Growth

Arbitrage

SBI Retirement Benefit Fund Conservative Hybrid Plan Direct Growth

Conservative Hybrid

HSBC Conservative Hybrid Fund Direct Growth

Conservative Hybrid

Bank of India Conservative Hybrid Fund Direct Growth

Conservative Hybrid

Explore More Mutual Funds

Equity Mutual Funds - Top Equity Fund Picks

Explore top equity mutual funds to diversify your portfolio. Filter by NAV, fund size, and more to find the best equity funds.

Debt Mutual Funds - Best Debt Fund Options

Discover top debt mutual funds for stable returns. Filter by NAV, fund size, and AMC to find the best debt funds for you.

Commodities Mutual Funds

Explore commodities mutual funds for diversification. Filter by NAV and fund size to find the best commodity funds.

ELSS Mutual Funds - Top Tax-Saving Funds

Discover top ELSS mutual funds for tax savings and growth. Filter by NAV, fund size, and AMC to find the best ELSS funds.

Large Cap Equity Funds

Find top large cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Mid Cap Equity Funds

Find top mid cap equity funds. Filter by AMC, NAV, and fund size to choose the best funds.

Frequently Asked Questions

How is the overall rating calculated?

The overall rating for Franklin India Debt Hybrid Fund A Direct Growth is an aggregate score based on performance metrics (returns over 1, 3, and 5 years), risk-adjusted returns (Sharpe and Sortino ratios), and consistency relative to its category. Ratings are on a scale of 1 to 5, with 5 being the highest.

What are the top stocks of Franklin India Debt Hybrid Fund A Direct Growth?

The top stocks held by Franklin India Debt Hybrid Fund A Direct Growth include Bajaj Finance Ltd., REC Ltd., Bajaj Housing Finance Ltd..

Which industries does Franklin India Debt Hybrid Fund A Direct Growth invest in?

Franklin India Debt Hybrid Fund A Direct Growth primarily invests in the following industries: Financial, Healthcare, Sovereign.

Who are the fund managers of Franklin India Debt Hybrid Fund A Direct Growth?

The fund managers of Franklin India Debt Hybrid Fund A Direct Growth are Rahul Goswami and Pallab Roy and Venkatesh Sanjeevi and Rohan Maru and Rajasa Kakulavarapu and Sandeep Manam.

How many years has the fund manager been managing Franklin India Debt Hybrid Fund A Direct Growth?

Rahul Goswami:

Calculating...

Pallab Roy:

Calculating...

Venkatesh Sanjeevi:

Calculating...

Rohan Maru:

Calculating...

Rajasa Kakulavarapu:

Calculating...

Sandeep Manam:

Calculating...

What is the minimum investment for Franklin India Debt Hybrid Fund A Direct Growth?

The minimum investment for Franklin India Debt Hybrid Fund A Direct Growth is ₹10000 for lumpsum investments and ₹500 for SIPs.

What are the average 1-year returns for Franklin India Debt Hybrid Fund A Direct Growth?

Calculating...

What are the average 3-year returns for Franklin India Debt Hybrid Fund A Direct Growth?

Calculating...

What is the expense ratio of Franklin India Debt Hybrid Fund A Direct Growth, and how does it compare to its category?

The expense ratio of Franklin India Debt Hybrid Fund A Direct Growth is 0.65%. The average expense ratio for similar funds in the Hybrid is Calculating....